Equity compensation can have a significant impact on your financial situation. On the one hand, it can accelerate the achievement of your financial goals. For example, if you receive equity compensation in the form of stock options, you may be able to exercise those options and sell the underlying shares at a profit. This could help you reach your financial goals sooner than if you had not received the equity compensation. However, on the other hand, equity compensation can also destroy a financial plan when not properly planned for. For example, if you receive a large amount of equity compensation that is not properly diversified, it could be concentrated in a single stock or sector and therefore be much more volatile than the rest of your portfolio. This could lead to your financial plan being derailed if the stock or sector falls in value. Overall, having equity compensation as a part of your overall financial plan is a positive thing! However, it also creates some complexities within your financial picture that require careful consideration and strategic planning. Let’s take a closer look.

Common Types of Equity Compensation

The three primary goals of equity compensation are to align incentives, attract and retain talent, and reduce cash spending. The stage of life of the company and the financial situation will determine what kind of equity compensation they will offer. The most common forms of equity compensation are:

- Restricted Stock Units

- Non-Qualified Stock Options

- Incentive Stock Options

- Restricted Stock Awards

- Employee Stock Purchase Plan

Restricted Stock Units are usually offered by large, established, publicly traded corporations (think Amazon, Intel, Microchip, etc.) while startups generally grant stock options. Employee Stock Purchase Plans are technically not equity compensation, but they are a great way to purchase company stock at a discounted rate.

Restricted Stock Units (RSUs) are the most common type of equity compensation given by publicly traded corporations. They are not to be confused with restricted stock awards, also known as stock awards or restricted stock. RSUs are defined as an agreement by the company to issue an employee shares of stock OR the cash value of shares of stock on a future date. The reason they are called “units” is because they are neither stock, nor options.

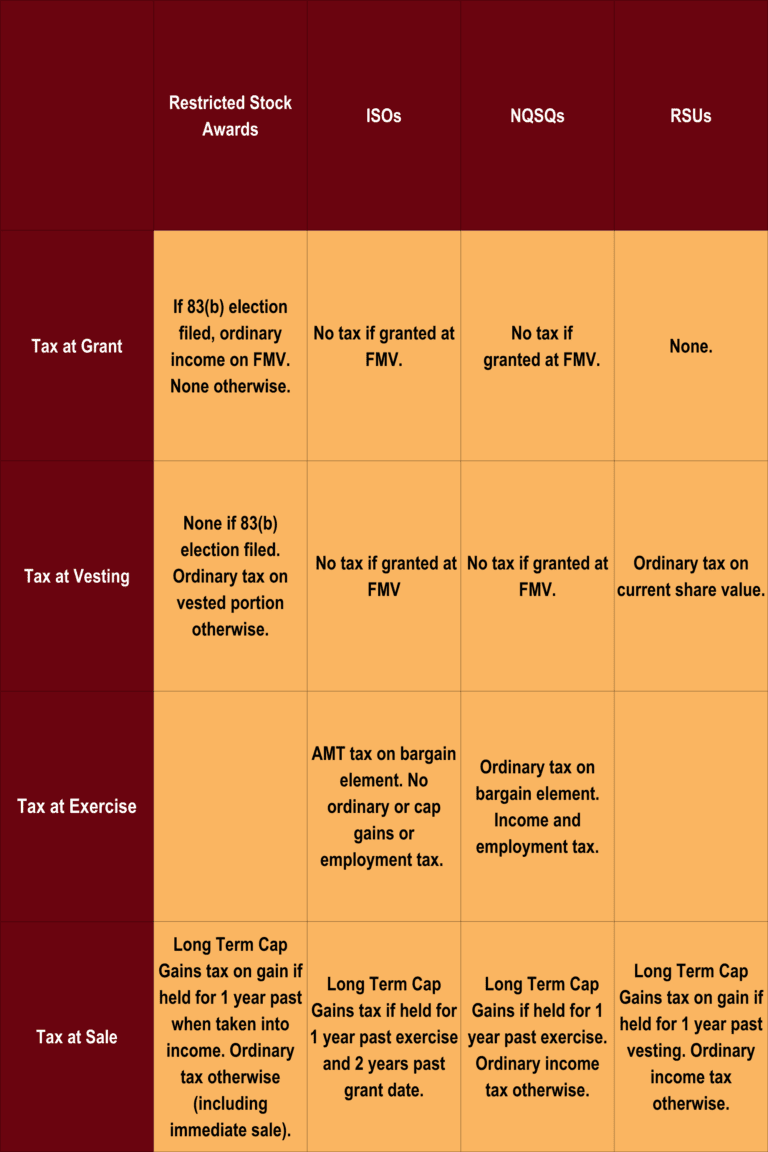

RSUs get taxed as the employee gains ownership or vests. (We’ll explain vesting in greater detail below.) Generally speaking, RSUs are not the preferred method of equity compensation from a tax planning perspective due to their lack of flexibility—RSUs do not qualify for an 83(b) election and, unlike stock options, the employee has no control over when they get taxed.

Stock Options are contracts granted by a company to an employee that give the holder the option to purchase a specific number of shares at a specific price. The purchase price is referred to as the strike price. The act of purchasing shares using options is called exercising. Stock options are not the same as stock, but rather the right to buy stock at a specific price under certain conditions, which are outlined by the employee’s stock option agreement.

There are two main types of compensatory stock options: Incentive Stock Options (ISOs) and Non-Qualified Stock Options (NQSOs). The main difference is how they are taxed upon exercise. ISOs are subject to AMT (Alternative Minimum Tax) but not employment tax (Social Security & Medicare), ordinary income tax, or capital gains tax. On the other hand, NQSOs are NOT subject to AMT but are subject to ordinary and employment tax. Additionally, the rules for qualifying for Long Term Capital Gains tax upon sale are slightly different. AMT is beyond the scope of this article, but it is important to be conscious of it and understand how big of an impact it can have on your financial situation.

Restricted Stock Awards are stocks that are granted to an employee. As the name suggests, these grants can come with transfer and vesting restrictions. These awards are typically limited to early hires and executives. Once again, it is important to note that restricted stock awards are NOT the same as Restricted Stock Units.

Employee Stock Purchase Plans allow employees to purchase shares of company stock at a discounted rate. While this may not technically be a form of equity compensation, it is the equivalent of buying shares of stock with a built-in gain.

Equity Compensation Considerations

Vesting

When an employee is vested, it means they have met the requirements to keep their employer-sponsored benefits. This usually happens after working for a company for a certain number of years, but it can also depend on other factors like reaching a certain age or making contributions to the plan. Generally, there are two types of vesting schedules. Graded vesting and cliff vesting. In a graded schedule a portion of the shares come under the ownership of the grantee as time passes, while on a cliff vesting schedule, the shares come under ownership in their entirety at the end of the vesting period. A graded vesting schedule could look like this:

Grant: 500 shares 1/1/2022 – 5-year graded vesting schedule

2023 – 100 shares vested

2024 – 100 shares vested

2025 – 100 shares vested

2026 – 100 shares vested

2027 – 100 shares vested

A cliff vesting schedule could look like this:

Grant: 500 shares 1/1/2022 – 3-year graded vesting schedule

2023 – 0 shares vested

2024 – 0 shares vested

2025 – 500 shares vested

Understanding vesting is important because if your equity compensation was subject to a cliff vesting schedule and you were to switch employers during the second year of the schedule, you would receive $0 in equity compensation and would be walking away from the entire 500 shares. If we replicate the same example and apply it to the graded vesting schedule you would be walking away from 300 shares. The amount of compensation being forfeited is an important consideration when planning an exit or a change of employers.

However, it’s not always that simple. If you receive stock options, it might be difficult to calculate the potential dollar amount you are walking away from due to options having both intrinsic and extrinsic (time) value. In essence, what this means is that options are leveraged instruments. Options with an expiration date far out in the future may have little intrinsic value but could have greater potential for appreciation than an option expiring this year. Although a complex topic in itself, vesting is an important consideration, especially when planning an exercise, exit, and/or divesting strategy.

Taxes

One of the biggest objectives in equity compensation planning is reducing the tax liability associated with it. Equity compensation can sometimes provide flexibility and tax advantages that ordinary wages cannot. An individual who receives equity compensation has control over when shares are sold and, in the case of options, also if and when shares are bought. To briefly exemplify the effect this can have, imagine the following scenario:

A single individual earns a base gross salary of $150,000, thus putting him in the 24% marginal tax bracket. He also has $1 million worth of bargain element in the form of NQSOs (we won’t consider employment tax in this example). If he exercises all of the options in one year, he will pay roughly $390,000 in Federal ordinary income tax for the year and $30,000 every year after that, totaling roughly $650,000 in ordinary income tax over 10 years. However, if he had opted towards exercising 10% of his position every year for 10 years, his total tax liability over 10 years would have been $610,000, a tax savings of $4,000 a year. However, this is also assuming the stock price remained constant over the 10-year period. If it increased over the 10-year period, the individual would have been better off exercising in a single year. So, then, what is the best plan of action? The answer is, there is no simple answer. The right plan will depend on various external factors, as well as factors particular to the individual. That is why equity compensation planning is so important.

All of this to say that WHEN options get exercised matters… a lot.

83(b) Election

The 83(b) election is a complex subject that does not often apply. It consists of accelerating when you pay tax on restricted stock by electing to pay taxes on the grant date rather than as it vests, the logic being that the stock value will be lower at the grant date than the vesting date. The caveat is you are paying tax on shares you don’t yet own, and you must make the election within 30 days of the grant date. This election is typically made by early startup shareholders. Additionally, this can only be done on shares and not on options or RSUs. However, options can be exercised and then the 83(b) election can be made on the shares of stock.

AMT Trap

AMT (as mentioned above) is a special type of tax that applies to high income earners, as well as individuals in special situations such as those exercising ISOs. AMT can create a huge issue when exercising ISOs because upon exercising your options you may not yet be vested and thus will be unable to sell shares and create liquidity to pay for the tax liability that has been created. This is the basis for the conundrum. A large AMT liability gets created when the bargain element (aka the spread between the exercise price and the 409A valuation) is large. This can be a substantial obstacle to plan around and it might be beneficial to seek professional advice. NQSOs are not subject to AMT.

Helpful Tax Table

As you can see, equity compensation can be a great way to boost your income and grow your wealth, but it can also be complex and confusing. There are many different types of equity compensation, and the tax implications can vary depending on your personal circumstances. It’s important to understand the pros and cons of each type of equity compensation before you make any decisions, so that you can create a plan that balances your company stock position, tax liability, and the integration with the rest of your financial plan. With careful planning, equity compensation can be a powerful tool to help you achieve your financial goals.

Contact us today to discuss the complexities of your equity compensation plan and its impact on your overall financial picture.