Charitable giving is a lot like the phenomenon of compound interest. Much like compound interest, charitable acts multiply exponentially until we can no longer keep track of them. The good nature behind charitable giving should be the primary motive to do it, but it can also be done efficiently in a manner that not only earns a notable tax benefit, but allows the charity to receive more dollars as well. Below we discuss 3 ways to give in a tax efficient manner:

Gifting Appreciated Non-Cash Assets

Many times, charitable gifts are made in cash due to simplicity. To gift more efficiently, the taxpayer could gift appreciated non-cash assets rather than selling the assets to then gift cash. Suppose the taxpayer had 100 shares of XYZ stock that were purchased for a total value of $5000 and are now worth $10,000. The taxpayer could directly gift the shares to the charity and pay no tax on the gain. The charity is tax-exempt and would receive $10,000 in stock and immediately sell it without incurring tax. The taxpayer would take a tax deduction equivalent to the FMV of the gift, $10,000, (assuming the taxpayer itemizes) and would have evaded capital gains tax. Assuming a marginal tax bracket of 24% and a Long-Term Capital Gains tax bracket of 15%, the tax benefit to the taxpayer would be $3,150 and the benefit to the charity would be $10,000. Had the taxpayer sold the shares and then gifted cash, the charity would receive $9,250 (the FMV of the shares minus the Long-Term Capital Gains tax paid by the taxpayer). The tax benefit to the taxpayer is calculated in the following manner:

$10,000 deduction x 24% marginal tax rate = $2,400

$5,000 gain x 15% capital gain rate = $750

$2400 + $750 = $3,150

Bunching Using Donor Advised Funds

Donor Advised Funds (DAFs) are charitable gifting accounts that allow for taxpayers to make charitable gifts while maintaining a degree of control over the funds. It is mainly geared towards those that make charitable contributions that are significant, but not sufficient to start a private foundation (generally under $1,000,000). Logistically, a taxpayer makes a gift of cash or property to the DAF and receives a charitable deduction in the year the gift is made. The funds can be invested in the account and distributed to any qualifying charity at any point in the future. Once a gift has been made to a DAF, it cannot be reversed. The taxpayer can only control how the funds are invested, which charity the funds go to, when the funds go to the charity, and the amount. A disbursement of the DAF to a charity is called a grant and grants are always made payable to the charity.

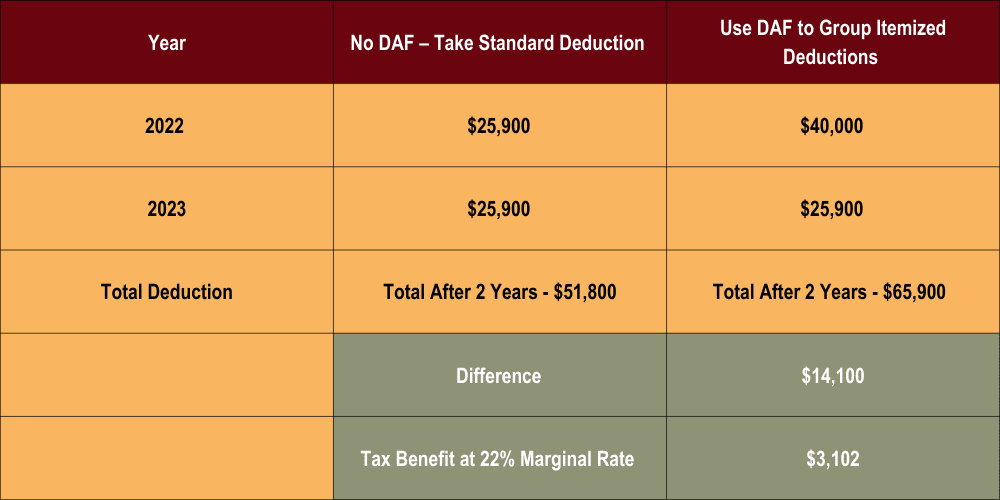

Since gifts made to a DAF can be distributed at any point at the discretion of the taxpayer, 2 years’ worth of charitable gifts (or any amount) can be made to the DAF and distributed on a yearly basis while taking the whole tax benefit in the first year (subject to the 30% and 50% limitations). For example, if a taxpayer tithes $10,000 a year, they could enter $10,000 for charitable contributions on their schedule A to count towards itemizing. However, using a DAF, the taxpayer could opt towards frontloading 2 years’ worth of charitable contributions, gift $20,000 to the DAF and distribute $10,000 from it every year. In year one, the taxpayer receives a deduction of $20,000 and no deduction in the remaining years. For taxpayers who do not itemize, but are charitable-inclined, bunching could allow them to receive a tax benefit for charitable giving. It is visually illustrated below:

Bunching vs. Non-Bunching

The illustration above demonstrates the value of bunching charitable contributions into one year along with itemizing mortgage interest and state and local tax (SALT) vs not bunching and taking the standard deduction every year.

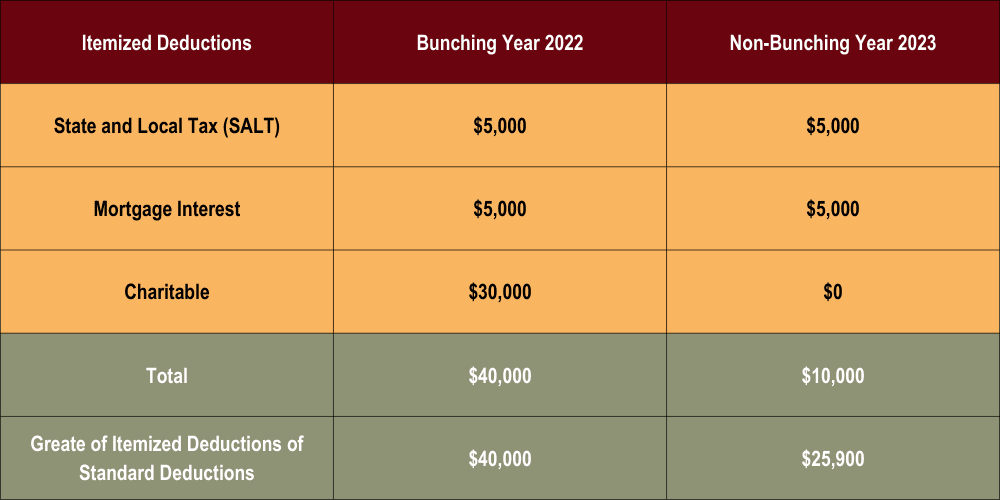

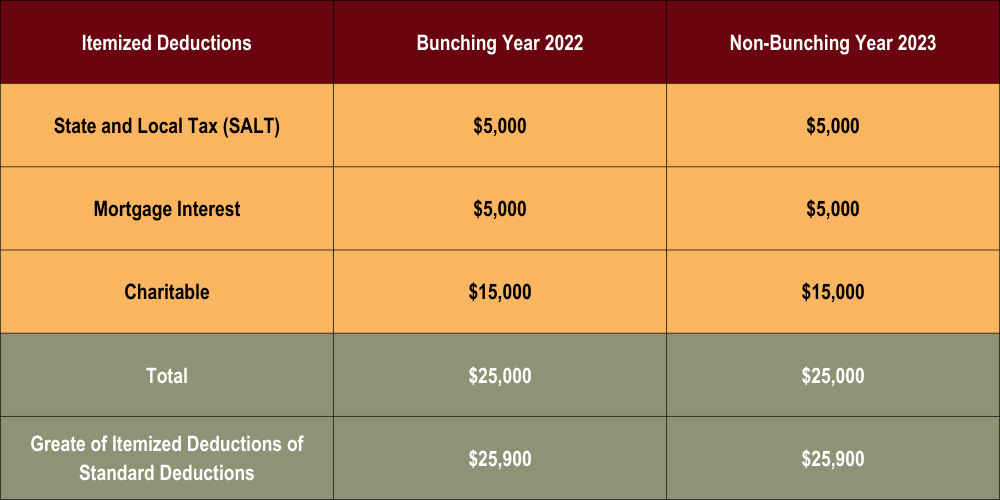

The following two illustrations demonstrate what occurs in each tax year with the bunching and non-bunching strategies.

Bunching Breakdown

Non-Bunching Breakdown

The tax benefit of donating to a DAF can be twofold when combining the bunching strategy and donating appreciated property. Tax savings are created by lowering taxable income and avoiding capital gains tax. It is important to note when donating appreciated assets, the deduction taken cannot be greater than 30% of Adjusted Gross Income (AGI). Cash donations are subject to the 60% AGI limit. Donations in excess of the limits can be carried forward for five years. If the standard deduction is taken during the carryover period, the carryover amount will be reduced.

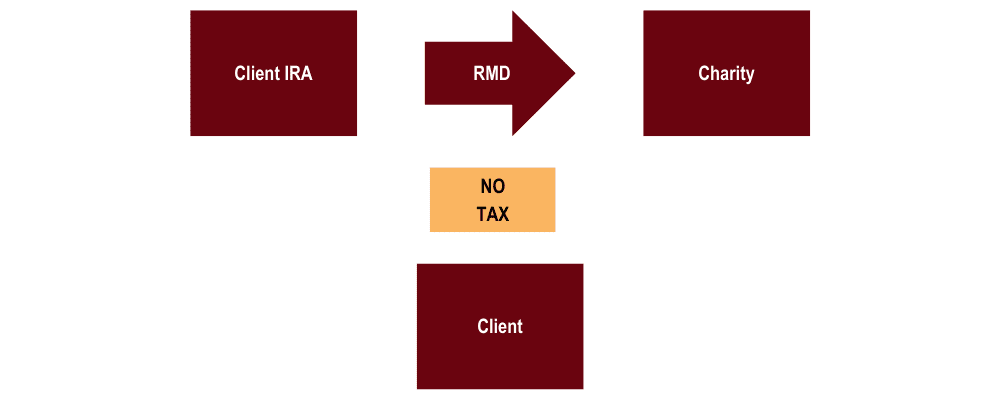

Qualified Charitable Distributions (QCD)

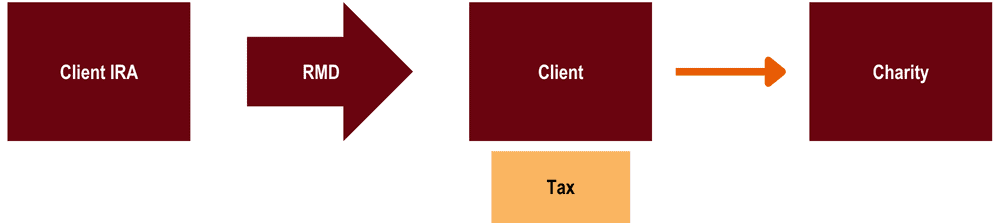

Qualified Charitable Distributions are a strategy that can be used by those subject to Required Minimum Distributions. Pre-tax IRAs and 401ks are subject to Required Minimum Distributions upon age 72. Distributions from pre-tax accounts are taxed at ordinary income rates. A QCD is a distribution from a pre-tax IRA that goes straight to the charity instead of going to the account owner and then to the charity. If a QCD is performed, the whole QCD amount is exempt from tax. For example, suppose your RMD for the year is $50,000 but you have a charitable contribution goal of $10,000. There isa multitude of ways you could go about meeting that goal, but opting for a QCD would kill two birds with one stone. You would distribute $10,000 from your pre-tax IRA directly to your charity. The remaining RMD would be $40,000 and allow you to meet your charitable goal for the year while not paying tax on the $10,000 charitable distribution.

In this example, the potential tax savings are calculated by multiplying the QCD amount by the marginal tax rate. If you gift $10,000 and are in the 22% tax bracket, the savings are $2,200. It is important to note the max QCD amount is $100,000 and QCDs may not be done to DAFs. A visual representation of a QCD is shown below.

Furthermore, even if you itemize, a QCD is an above the line deduction that reduces your AGI (which calculates your Medicare premiums among other things). For this reason, it is more advised to take a QCD even if you itemize.

Non-Qualified Charitable Distribution

Qualified Charitable Distribution

Tax efficiency is an important aspect of charitable giving that many people overlook. There are several ways you can maximize the efficiency of your charitable giving and benefit both yourself, and, most importantly, your favorite charity. If you’re ready to give, but don’t know where to start, we’re happy to help develop a plan to make the most of your charitable giving.