Table of contents

This month, we are pleased to feature an article by guest contributor Nathan Wilding, Tax Accountant at Fox Peterson Entrepreneurial Accountants in Mesa, Arizona. At Sonmore Financial, we work closely with clients’ CPAs and tax professionals to provide an integrated financial planning experience.

Inheriting an IRA can offer a significant financial boost, but without careful planning, the Required Minimum Distribution (RMD) rules could create unexpected tax consequences. The decisions you make about when and how to withdraw from an inherited IRA can substantially impact your overall financial health. If you’re an Arizona retiree navigating inherited IRAs and other complex retirement decisions, our free Arizona Retiree Toolkit provides tailored guidance to help you optimize your strategies and minimize taxes. Download your copy here and take control of your financial future. In this post, we’ll explore tax strategies to help you minimize your burden, using real-world scenarios to show how timing distributions based on changes in income can save you money.

Understanding the Basics: Inherited IRAs and RMDs

When you inherit an IRA, you must follow specific withdrawal rules. Under the SECURE Act of 2019, most non-spouse beneficiaries must deplete the account within ten years of the original owner’s death. These distributions are typically subject to income tax, but the timing and amount of distributions are flexible during this 10-year window, allowing for strategic planning. How you choose to spread out withdrawals can significantly affect your overall tax liability.

One item of note: If the original owner of the IRA had turned 73 before passing or would have turned 73 during the ten years after, then you must fulfill the RMD requirement, which limits the flexibility of the 10-year rule but still leaves plenty of room for tax planning.

Let’s explore four common scenarios for John and Jane, a married couple, to see how different inherited IRA strategies can impact taxes.

Case Study: A $400,000 Inherited IRA

John, 50, earns $123,500 annually and recently inherited a $400,000 IRA from his father. He has ten years to deplete the account fully but must decide how to structure his withdrawals. His wife, Jane, is currently not working but is planning to return to the workforce soon, which would increase their household income. Additionally, John plans to retire in six years, leading to a significant drop in their income. Also included in this case study for scenario two is the potential increase in tax rates for the tax year 2026 as the Tax Cuts and Jobs Act expires. Scenario 1 avoids this increase.

Below, we’ll explore four different distribution strategies:

Distributing over two years

Distributing over ten years

Optimizing for Future Retirement

Optimizing for increased income when Jane returns to work

Scenario 1: Distributions Over 2 Years

If John decides to take distributions over two years, he must withdraw $200,000 annually. Here’s how this would impact his taxes:

Tax Years 2024 and 2025:

John’s salary of $123,500, plus the $200,000 distribution, brings their total income to $323,500, which pushes them into the 24% tax bracket. The distribution would be taxed at 24% and 22%, resulting in an additional tax bill of around $45,865 annually.

Total Tax Liability:

Over the two years, John would pay about $91,730 in taxes on the $400,000 IRA.

Scenario 2: Distributions Over 10 Years

If John spreads the distributions over ten years, he will withdraw $40,000 annually ($400,000 ÷ 10). Here’s how this option affects his taxes:

Tax Years 2024 and 2025:

Adding $40,000 in distributions to John’s $123,500 salary brings his total income to $163,500, which keeps him within the 22% tax bracket, meaning the tax on this distribution would be $8,800 annually.

Tax Years 2026 and Beyond:

If tax rates revert to pre-2018 levels, John’s $163,500 income would fall into the 25% bracket. The tax on the $40,000 distribution would rise to $10,000 annually.

Total Tax Liability:

Over ten years, John would pay around $97,600 in taxes on the inherited IRA, assuming two years at 22% and eight years at 25%.

Scenario 3: Optimizing for Retirement on the Horizon

John plans to retire in Year 6, dropping his annual income from $123,500 to $52,400. This scenario presents an opportunity to reduce his tax burden by front-loading smaller distributions while he is still working and taking larger withdrawals post-retirement when his income is lower. This scenario assumes similar tax rates year to year.

Years 6-10 (Post-Retirement):

After retirement, with John’s income dropping to $52,400, he could withdraw $71,100 per year while staying within the 12% tax bracket, resulting in $8,532 in annual or $42,660 in total taxes over five years.

Years 1-5 (Pre-Retirement):

While John earns $123,500, this leaves $8,900 per year, which would be taxed in the 22% tax bracket. It would result in $1,958 in yearly taxes, amounting to $9,790 in total taxes over five years.

Total Tax Liability:

By planning around his retirement, John could withdraw all $400,000 and pay $52,450 in taxes over ten years.

Scenario 4: Optimizing for Increased Income as Spouse Re-Enters the Workforce

Jane plans to re-enter the workforce in two years, adding $100,000 to their household income to $223,500. This increase in income keeps them in the 22% tax bracket with little room to spare, so front-loading larger withdrawals before Jane returns to work is a smart move.

Years 1-2 (Before Jane Re-Enters Workforce):

While Jane isn’t working, John should take more significant distributions—around $106,749 per year—to take advantage of their lower 22% tax rate. The tax on this would be $23,485 annually, resulting in $46,970 in total taxes over two years.

Years 3-10 (After Jane Returns to Work):

Once Jane earns $100,000, their combined income of $223,500 gets them close to the 24% tax bracket. John could reduce withdrawals to $23,313 annually, paying an additional $5,460 in taxes annually or $43,680 in total taxes over the remaining eight years.

Total Tax Liability:

By front-loading distributions, John would pay $90,650 in taxes over ten years before Jane re-enters the workforce.

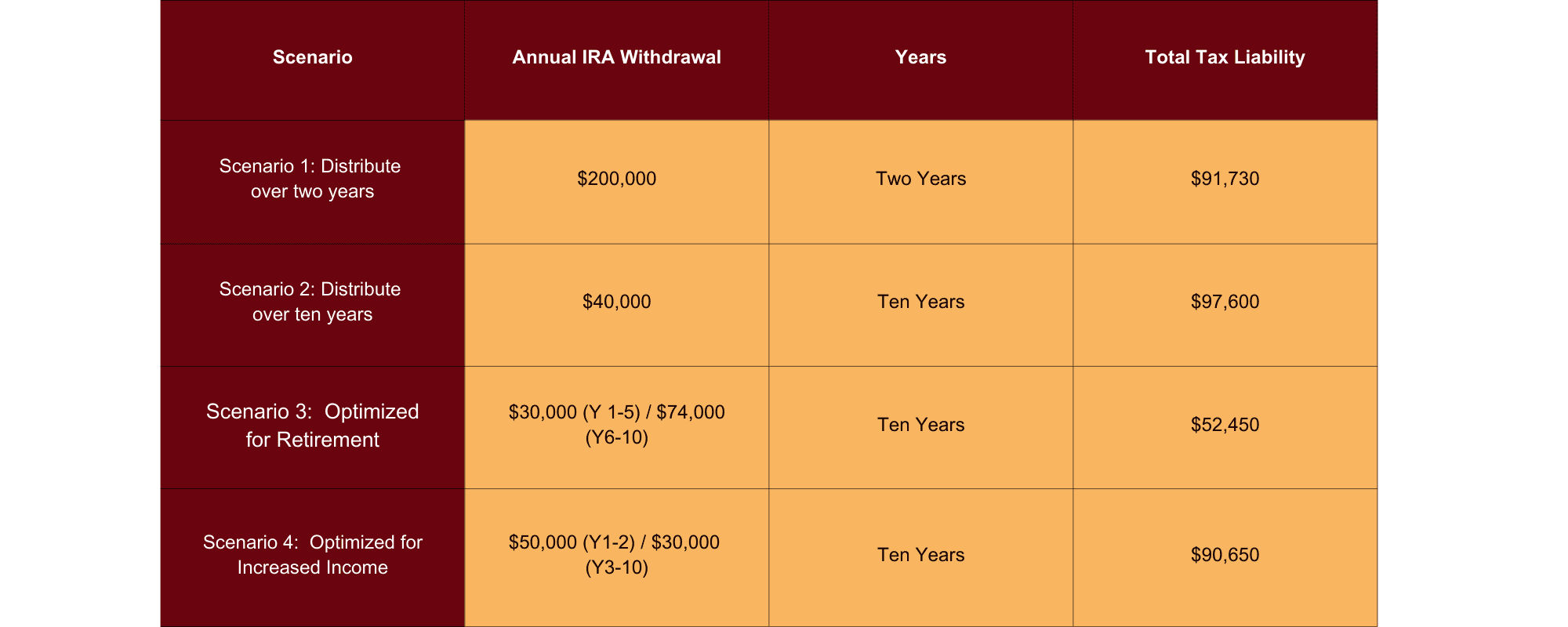

Summary Table of Scenarios

Conclusion

When planning your inherited IRA distributions, it’s crucial to consider current and future income changes. In John’s case, distributing his IRA over six or ten years creates different tax liabilities. Still, optimizing withdrawals based on his and Jane’s income changes is the most significant savings.

In Scenario 3, John leverages his post-retirement years to take more significant distributions at a lower tax rate, reducing his overall tax burden.

In Scenario 4, John front-loads distributions before his wife’s return to the workforce, minimizing the tax impact once they enter a higher tax bracket.

If you’re facing a similar situation, working with a financial advisor can help you create a strategy that minimizes taxes while maximizing your inheritance.

Disclosure: All content is for information purposes only. It is not intended to provide any tax or legal advice or provide the basis for any financial decisions. Nor is it intended to be a projection of current or future performance or an indication of future results. The information provided is not based on actual current or past clients. All situations are unique, and results will differ depending on the individual situation.