Table of contents

The largest expense many professionals will have in retirement is taxes.1 No matter how patriotic you might be, I’m sure we would both jump at the opportunity to minimize our lifetime tax bill. In order to help accomplish this goal, it’s important to understand what tools we have available to shelter dollars from tax, how those tools are taxed, and when it makes sense to use each one.

Tax Treatment

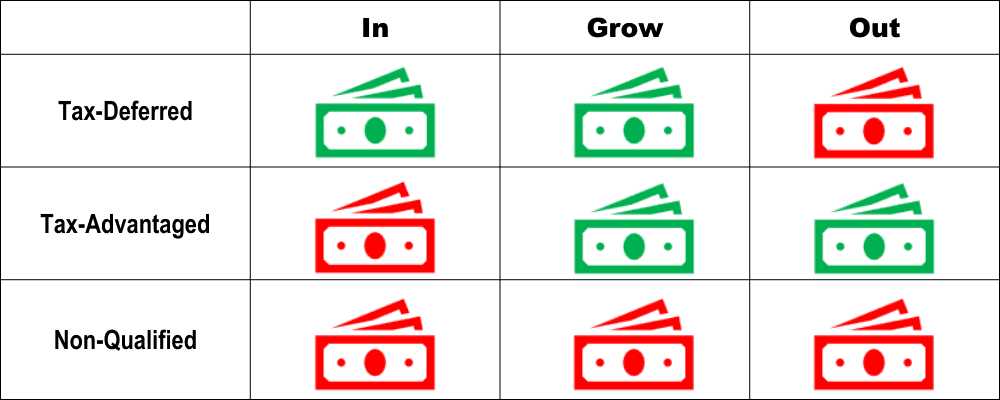

There are three common taxation types of accounts: tax-deferred, tax-advantaged, and non-qualified or taxable accounts:

Tax-Deferred

This encompassed all types of accounts to which a contribution is made and a tax deduction against income is taken for the contribution amount in the year in which it is made. Examples include Traditional IRAs, SEP IRAs, and traditional 401ks. The benefit of contributions to these accounts is that they lower your taxable income. For example, if you made $100,000 and contributed $20,000 to a 401k on a pre-tax basis, you would be taxed as if you made $80,000 ($100,000 – $20,000 = $80,000). Once you begin taking qualified distributions from the account, you pay ordinary income tax on the entirety of the distribution at the tax rates in the future. For example, if in the future you take a qualified distribution from a pre-tax account in the amount of $100,000 and your marginal tax rate is 22%, you would pay $22,000 in tax ($100,000 x .22 = $22,000).

Tax-Advantaged

A Roth IRA is an example of a tax-advantaged account. Due to changes brought by the SECURE Act 2.0 passed in December 2022, many more types of retirement accounts can have Roth contributions made to them, including SEP and SIMPLE. You can learn more about SECURE 2.0 here. When Roth contributions are made, there is no deduction against income, meaning if you earned $100,000 and made a $20,000 contribution to a Roth 401k, you would still be taxed as if you earned $100,000. These contributions will grow tax-free and once a qualified distribution is made, the distributions will also come out tax-free.

Non-Qualified Treatment

Contributions to an account that is classified as “non-qualified” are not deductible. In addition, any dividends or interest paid is taxable even if reinvested and if a position is sold at a gain, it is subject to capital gains tax. Basically, this treatment has none of the benefits that pre-tax or Roth accounts receive, however, that does not make non-qualified accounts a bad tool. What they lack in direct tax efficiency they make up in flexibility. These accounts are not subject to contribution limits or restrictions on when funds can be accessed. Furthermore, gains and losses can be strategically realized in order to generate liquidity and cashflow while potentially incurring a minimal tax liability, which can be crucial when planning for pre-65 healthcare. Additionally, for someone in the 24% marginal income tax bracket, it may be more advantageous to pay long-term capital gains tax of 15% instead of ordinary income tax of 24%. Lastly, for estate planning purposes, non-qualified assets can be more efficient than pre-tax assets, as they receive a step-up in basis upon the passing of the owner and are not subject to required minimum distributions.2

For example, if Johnny was the sole owner of a non-qualified account with mutual funds that he purchased for $100,000 (this is his cost basis), and at his passing the account is worth $300,000, that would mean there is a gain of $200,000. The beneficiary would receive a step-up in cost basis and the new basis of the mutual funds would be $300,000. Since there is no longer any gain in the account, the beneficiary could sell all the mutual funds and incur no tax.

Below is a visual of the tax treatments discussed:

What if I make too much money to contribute to a Roth IRA?

As you may know, the tax-sheltered accounts into which we want to put our dollars have limitations and restrictions, such as contribution and/or eligibility limits.

For single taxpayers who make more than $153,000 in 2023, and married taxpayers who make more than $228,000, the eligibility to make contributions to a Roth IRA (not to be confused with a Roth 401k) is nearly nonexistent.3 However, the “Backdoor Roth IRA” could be a way to fund Roth IRAs for high-income earners. This method consists of making a non-deductible contribution to a Traditional IRA and then converting those dollars to a Roth IRA. Come tax time it would be important to file Form 8606 to inform the IRS that the contribution made to the Traditional IRA was non-deductible.4 Otherwise, all contributions made to Traditional IRAs are assumed to be pre-tax, thus making our conversion to Roth taxable.

I understand the tools but when do I use what?

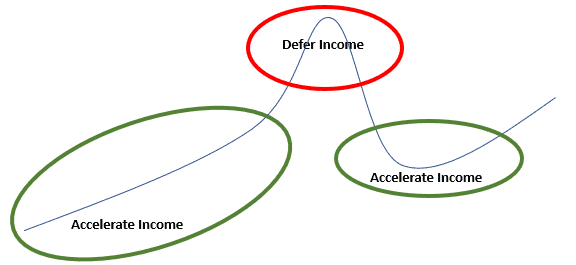

Conceptually, we want to accelerate income in our low-income years and defer income in our high-income years. In other words, we want to pay tax when income is low and take deductions when income is high. Below is a visual illustration of that concept:

When we are in our high-income years—typically the 5 years preceding retirement—we want to consider making pre-tax contributions, and in lower income years we want to consider making Roth contributions and/or doing Roth conversions. You can learn more about Roth conversions here. In low-income years post-retirement there are additional considerations, such as phase-in of increased Medicare Part B Premiums, qualifying for an Affordable Care Act health plan, and taxability of Social Security.

Concluding Thoughts

Many taxpayers have access to the same tools when it comes to their retirement savings, however, how these tools are used can affect the outcome of the taxpayer’s situation differently. By planning appropriately, one of the headwinds in retirement, taxes, can be reduced, leading to a potentially more enjoyable retirement. If you’re curious about optimizing your tax situation, we are happy to hop on a call and be a sounding board.

Sources:

- FINRA, n.d.

- Cornell Law School, n.d

- Charles Schwab, n.d

- Publication 590-A, 2023