We pride ourselves on being a stoic leader for our clients; one who can speak logic into emotions when times are better than normal, as well as when times are worse than normal. We believe there are two sides to money and investing—an emotional or qualitative side, and a numerical or quantitative side—and thus implementing tools and strategies that optimize both is essential. We base our investment philosophy on empirical research rather than opinions and fads, and we employ behavioral tools as part of our philosophy with the goal of helping clients have peace during a storm. We abide by an investment approach that is passive yet disciplined, strategic rather than tactical, and planning-driven rather than opportunistic/short-term. Our investment philosophy is derived from the following foundational principles:

- Global Diversification

- Fama-French 5 Factor Model

- Investor Ability + Appetite for Risk

- Behavioral Management

- Long-Term Horizon

- Tax and Cost Efficiency

Over this three-part series we will cover all parts of our investment philosophy. In part one we will discuss Global Diversification and the Fama-French 5 Factor Model.

Global Diversification

Diversification is the idea that if we have a variety of investments that perform differently, we will be able to reduce the overall risk of losing money due to spreading out the risk between multiple asset classes. If properly diversified, in any given year we will have some assets that are down and some assets that are up; averaged over a long period of time we will have experienced overall growth while reducing the peaks and valleys of our portfolio. If all our assets move up and down together and to the same extent—in other words, if they are heavily correlated—we are not actually diversified. Stated simply, this concept can be summarized by an adage that your grandmother might have shared with you: “Don’t put all of your eggs in one basket”.

Sometimes investors believe that by owning a US stock index fund they are properly diversified because US companies operate globally. While a US stock index like the S&P 500 or the Nasdaq 100 is indeed diversified, the data would not support the claim that either of those indices perform as anything other than US Large Cap stock. Furthermore, an index like the S&P 500 is not actually as diversified as it sounds due to how it’s weighted, which can be a double-edged sword. By owning the S&P 500 or the Nasdaq by themselves we don’t really have our eggs in different baskets, but rather we have a lot of eggs in the same basket. If the basket was to be dropped, a good portion of the eggs would be splattered, some would crack, and a few would be seemingly intact.

For example, take a look at the period of time commonly referred to as “the lost decade”—the 10-year period starting in 2000 and ending in 2010, during which a lump-sum investment of $100,000 in US Stock would have earned an annualized return of -0.9%.1 If you had instead invested in the Nasdaq 100, the story is even worse—you would have realized a -5.5% return.1 On the other hand, the five years leading up to this 10-year stretch could have convinced anyone that diversification is foolish and that you should put all of your money into the S&P 500 or Nasdaq. From 1995 to 2000, the S&P 500 earned a staggering annualized return of 28.6%1 and over the same period, the Nasdaq earned a return of 40.2%!1 However, reality set in shortly thereafter, and the importance of diversification once again shone bright, as well as the importance for proper behavioral management during periods of economic euphoria.

So, you might be asking yourself, what does true diversification actually look like? To answer that, let’s look at two things that would have completely altered the picture had the euphoric US Large Cap investor chosen to go down those routes: allocation to different sized companies, and allocation to foreign companies. Take for example the annualized performance of the Dimensional US Small Cap Index over that same period of 2000-2010: 1

- From 2000 to 2010 the annualized return was 8%.

- At no point during 2000 to 2010 did the Dimensional US Small Cap Index have a negative annualized return, while the S&P 500 had eight and the Nasdaq had 10.

- Allocations to this index would have not only helped performance but would have also greatly reduced the extreme volatility experienced over that time period.

If we look at the MSCI World ex USA Index, an index that tracks the performance of stocks in 22 of 23 developed countries, we’ll find that from 2000 to 2010 the annualized return was 2.0%,1 not as impressive as the Dimensional US Small Cap Index but still greater than -0.9% realized by the S&P 500.

Finally, the MSCI Emerging Markets Index, which tracks the performance of stocks in 26 emerging markets countries such as Brazil, India, Mexico, and South Korea, had an annualized return of 10.1% from 2000 to 2010,1 over that same time period by far the best performer out of the indices we have discussed.

If we blend these concepts together, we get the Dimensional Core Wealth Index Model. Please note that this model possesses an allocation to Global Real Estate along with tilts in line with Dimensional’s Factor Investing philosophy which will be discussed shortly. Below is the structure and allocation of Dimensional’s Core Wealth Equity Index Model:1

- Dimensional US Adjusted Market 1 Index – 34.5%

- This index represents US Large Cap Stock

- Dimensional US Adjusted Market 2 Index – 34.5%

- This index represents US Small Cap Stock

- Dimensional International Adjusted Market Index – 19%

- Dimensional Emerging Markets Adjusted Market Index – 9%

- S&P Global REIT Index – 3%

From 2000 to 2010, this model earned an annualized return of 4.8%1 – nothing to do cartwheels about but far better than a return of -0.9%1 and with less volatility. Obviously, we cannot use past performance as an indication of future results, but we can observe that over those time frames, global diversification was helpful in realizing a more favorable investment experience.

Fama-French 5-Factor Model

When it comes to our philosophy around investment in equities, we are firm believers in the Fama-French 5-Factor model developed through the scientific research of Nobel Laureate Eugene Fama and Kenneth French. Through their research, Fama and French found that there are five factors that drive equity returns: 2

- Market Risk – More volatile stocks have a higher expected return to compensate for the increased volatility based on the Capital Asset Pricing Model (CAPM). (CAPM is a foundational theory in finance and is used to calculate the expected return of an asset.)

- Size – Stocks of small firms tend to earn higher average returns than stocks of large firms.

- Value – Value stocks (stock with high book-to-market ratios) tend to outperform growth stocks (stocks with low book-to-market ratios).

- Profitability – companies that are more profitable tend to have higher average returns than those that are less profitable.

- Investment – Firms that invest conservatively (lower growth in assets) tend to have higher average returns than those that invest aggressively.

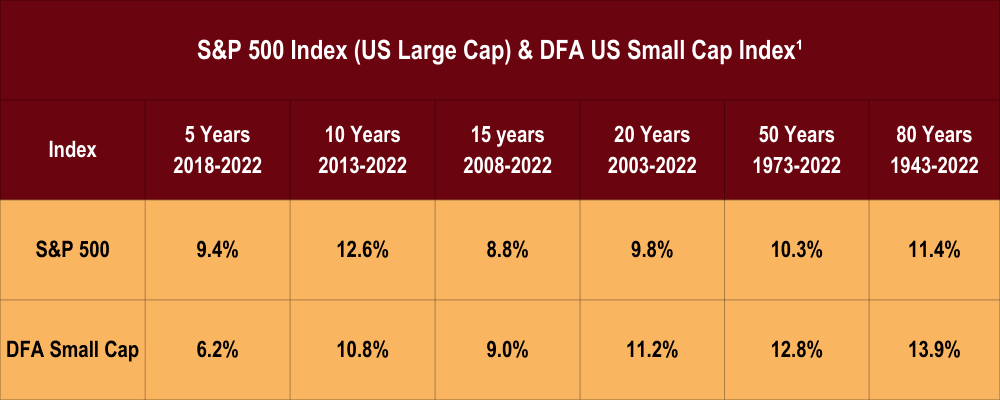

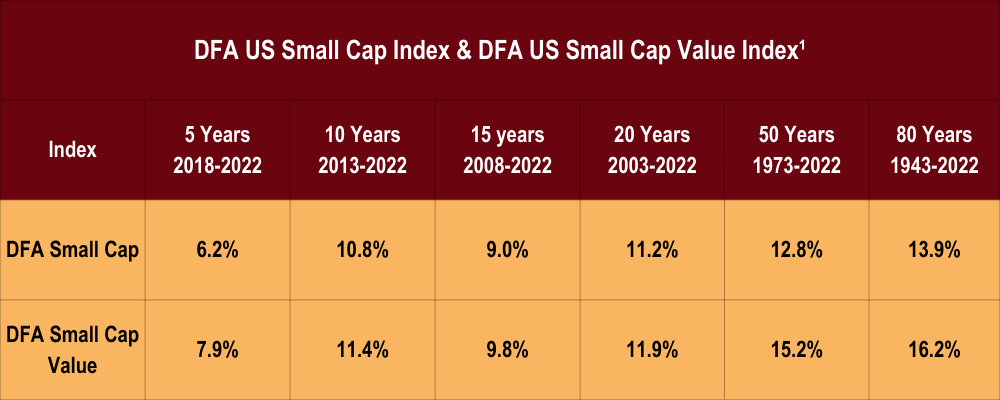

Fama and French serve as consultants of Dimensional Fund Advisors (DFA) and their research has been at the core of DFA’s investment philosophy. By virtue of owning DFA funds in our portfolios, we carry strategic tilts towards these five factors that have historically earned investors a premium over long periods of time. This can be observed when comparing a Large Cap Index with a DFA Small Cap Index and a DFA Small Cap Index with a DFA Small Cap Value Index. This is not an endorsement of DFA funds or products, it is simply the observance of the academic work of Fama-French in practice.

Conclusion

With an unwavering commitment to empirical evidence over market hype and emotional decision-making, we serve as a steadying force for our clients. The comparison of the different indices and models covered here offers compelling evidence that a well-thought-out, diversified strategy can outperform single-asset or narrowly focused portfolios.

While we understand that past performance is no guarantee for future results, we believe that a disciplined and scientifically grounded strategy puts our clients in position for financial success.

At Sonmore, we don’t just manage investments; we manage trust, long-term relationships, and most importantly, peace of mind during financial storms. This philosophy is what makes us not just a financial advisor, but a dependable partner in your life’s journey.