Table of contents

Roth conversions are a great planning tool that can potentially lower one’s lifetime tax bill. The strategy consists of converting tax-deferred dollars from a 401(k) retirement account or traditional IRA into a Roth account, creating a taxable event. The dollars converted from the tax-deferred account to a Roth are taxed as Ordinary Income. From a big-picture perspective, the strategy is not much more complex than comparing two sets of marginal rates. For example, let’s say this year an individual knows they will be in the 12% marginal tax bracket, but next year their partner will begin working and the household will get bumped up all the way to the 24% marginal tax bracket. A question they should ask themselves is: Would I rather pay tax at a known rate today or at the potentially higher unknown rate of the future?

Given the choice between a tax rate of 12% and 24%, a wise person would choose 12%. In our example, the year during which this individual will be in the 12% tax bracket is prime time for Roth conversions. However, there are some other, more complex rules we must keep in mind when doing Roth conversions. In this article we cover two Roth conversion pitfalls and one common misconception, as well as how to handle those pitfalls like a pro.

The Five-Year Rule

For a distribution from a Roth IRA to be considered qualified, i.e. tax-free, it must meet the following criteria:

- It is executed after the 5-year period beginning with the first tax year for which a contribution was made to a Roth IRA set up for your benefit.

- The payment or distribution is:

- Made on or after the date you reach age 59-1/2,

- Made because you are disabled

- Made to a beneficiary or to your estate after your death, or

- One that meets the requirements listed under First Home (up to a $10,000 lifetime limit).1

However, there are some exceptions to these rules due to the distribution order of Roth IRAs and how they are taxed. The distribution order is as follows:

- Contributions (always tax-free)

- Conversions and rollovers

- Earnings

Let’s look at the following scenario as a simplified example:

- Roth IRA with a value of $100,000

- $20,000 in contributions

- $80,000 in earnings

- The individual is age 65

- Meets 5-year rule

This individual meets the 5-year rule and has $20,000 in contributions that can be withdrawn tax free at any time. In addition, she meets the 5-year rule and can also access earnings tax- and penalty-free.

What’s particularly crucial to note is that each Roth conversion has a 5-year rule. Earnings from the account can’t be accessed until all contributions and conversions have been distributed, regardless of whether those earnings are attributable to contributions or conversions, meaning that by doing a Roth conversion you essentially place a 5-year lock-up on all the earnings in your Roth IRA.

So, what happens if the individual from the example above does a conversion from their IRA to their Roth IRA in the amount of $10,000?

In that scenario, the individual would now have a Roth IRA comprised in the following manner:

- Value – $110,000

- Contributions – $20,000 – accessible tax-free at any point

- Conversion in 2024 – $10,000 – accessible tax-free in 2029

- Earnings – $80,000 – accessible after contributions and conversions are distributed

If next year another conversion of $10,000 was done, then the composition would be the following:

- Value – $120,000

- Contributions – $20,000 – accessible tax-free at any point

- Conversion in 2024 – $10,000 – accessible tax-free in 2029

- Conversion in 2025 – $10,000 – accessible tax-free in 2030

- Earnings – $80,000 – accessible after contributions and conversions are distributed

This situation could have a major impact on one’s financial planning. If someone who met the 5-year rule and was age 59.5+ intended to take distributions from their Roth IRA in the next 5 years, they might consider delaying Roth conversions, distributing their entire account, or changing their timeline. On the other hand, not planning for the 5-year lockup period could result in unintended taxes and penalties if it became necessary to use the dollars in the Roth IRA.

It’s also important to note that if Roth dollars are rolled into a Roth IRA from a Roth 401(k), those Roth dollars are treated just the same as a conversion and have their own 5-year rule. Therefore, if the intent is to use the dollars in the Roth 401(k) within the next 5 years, it might be best not to roll them into a Roth IRA.

Income Related Monthly Adjustment Amount (IRMAA)

The Income Related Monthly Adjusted Amount, or IRMAA, relates to the cost of Medicare Part B. Medicare Part B covers things like services from doctors, outpatient care, home health care, and durable medical equipment. For people who are already taking their Social Security benefit, the premium for Medicare Part B comes of their gross monthly benefit. The cost of the premium is based on income, more specifically, a special Modified Adjusted Gross Income (MAGI) amount that is not the same as the MAGI calculation used for Roth contributions.

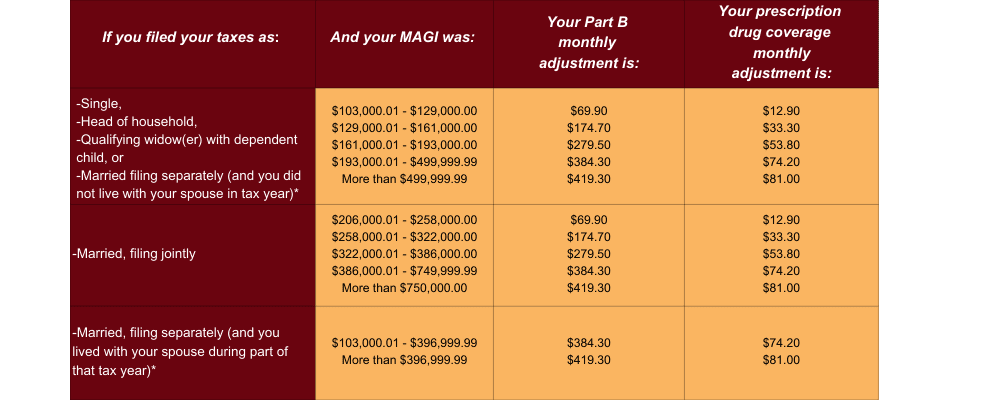

To calculate your IRMAA premium, the Social Security Administration looks at your income from two tax years ago. In short, the amount is your gross income plus your entire Social Security benefit. They then compare it against the table outlined below (figures are adjusted annually) and determine your premium amount.

Source: https://www.ssa.gov/forms/ssa-44.pdf

What does IRMAA have to do with Roth conversions?

The reason IRMAA matters is that someone might unintentionally create a tax for themselves by doing Roth conversions. For many people, especially those with pensions or other significant recurring income, it might make sense to do Roth conversions in the 22% marginal bracket, the 24%, and maybe even the 32% tax bracket, but it would also assuredly result in higher IRMAA premiums.

In this situation, it may still make sense to do Roth conversions, but it’s important to be aware of the implications and consider them when calculating the cost of Roth conversions. Additionally, if one is strategic, it is possible to petition the Social Security Administration to waive the premium increase if any of six life-changing events occur:

- Marriage

- Divorce

- Death of a spouse

- Work stoppage or reduction

- Loss of income-producing property

- Employer settlement payment

Sometimes spouses retire in different years, which can result in a lower income year historically speaking, and possibly provide a bigger margin for Roth conversions. In addition, it’s a good time to move through IRMAA brackets by filing Form SA-44 and qualifying for the life-changing event of “Work Stoppage.” If the outcome is that the increase in premium is waived, it could result in savings of $5,000-$10,000.2

A Common Misconception

As you may already know, Roth IRAs have individual income limitations in terms of who can contribute to them. If you’re a single filer and make more than $161,000—or a joint filer making more than $240,000—you can’t contribute directly to a Roth IRA. However, what if you’re a single filer making $100,000 and do a Roth conversion for $100,000? By the limitations outlined above, that taxpayer would be ineligible, but the IRS omits Roth conversions from the MAGI calculation used to determine contribution eligibility. More on this can be found in IRS Pub. 590-A.

Conclusion

Navigating the complexities of Roth conversions can be challenging, but understanding the pitfalls and misconceptions is crucial for making informed financial decisions. The five-year rule and the distribution order are vital to keep in mind to avoid unintended taxes and penalties. Strategically planning conversions, especially considering IRMAA implications, can help mitigate unexpected costs and optimize long-term benefits.

Despite the intricacies, Roth conversions remain a powerful tool for managing your tax burden over your lifetime. By carefully considering your current and future tax brackets, the potential impact on Medicare premiums, and the rules surrounding contributions and distributions, you can make the most of this strategy. Whether you’re looking to maximize tax efficiency, ensure financial security in retirement, or leave a tax-free legacy, understanding and leveraging Roth conversions can provide significant advantages.

Key Takeaways:

- Five-Year Rule:

- Each Roth conversion has its own five-year period.

- Earnings can only be accessed tax-free after all contributions and conversions are distributed.

- IRMAA: High-income years due to Roth conversions can increase your Medicare Part B premiums.

- Common Misconception: Roth conversions do not count towards MAGI limits for Roth IRA contributions.

Further Reading and Resources

- For a deeper exploration of the Five-Year Rule, consider reading our recent blog post “Understanding the Roth IRA Five-Year Rule: Strategies and Implications for Investors.”

- IRS Publication 590-A for detailed rules on Roth contributions and conversions

- Financial Calculator to estimate the impact of Roth conversions

- Medicare IRMAA Information for more details on how IRMAA is calculated

With careful planning and a clear understanding of the rules, you can turn the potential pitfalls of Roth conversions into opportunities for a more secure financial future.

Source:

https://www.irs.gov/pub/irs-pdf/p590b.pdf

https://www.ssa.gov/forms/ssa-44.pdf