Table of contents

For many retirees, effective tax planning is a pivotal aspect of maintaining financial stability and maximizing resources. One tool that is often underutilized, yet can offer significant tax advantages, is the Qualified Charitable Distribution (QCD). In this blog, we’ll explore how QCDs can be a game-changer for your retirement strategy today and even more so with expected tax changes coming in 2026.

What are Qualified Charitable Distributions?

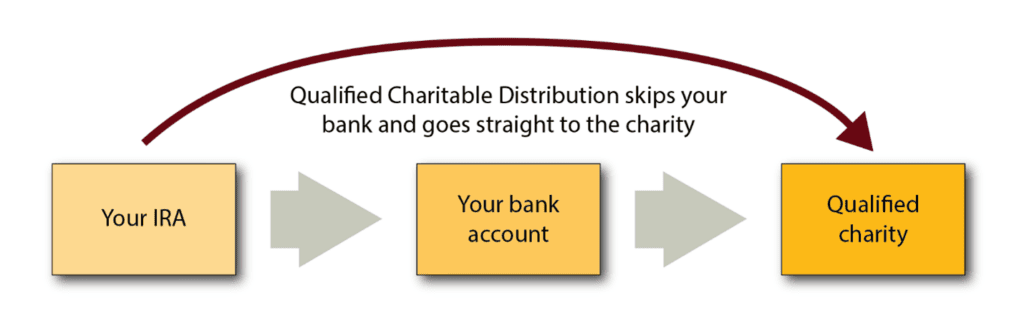

Qualified Charitable Distributions allow individuals aged 70 1/2 or older to donate up to $105,000 directly from their Individual Retirement Account (IRA) to a qualified charity, without the distribution being included in their taxable income. This can be particularly advantageous for retirees who have reached the age where Required Minimum Distributions (RMDs) are mandatory from traditional IRAs, which now starts at age 73, creating a small window where QCDs can be made without the RMD requirement.

The Tax Efficiency of QCDs

The primary benefit of using a QCD is its impact on Adjusted Gross Income (AGI). Unlike regular charitable giving, which might only offer a tax deduction if you itemize (becoming less common as fewer retirees have significant mortgage interest deductions and typically lower income levels), a QCD directly reduces your AGI. This reduction may offer several advantages:

- Lower Taxable Portion of Social Security: A lower AGI means potentially less of your Social Security benefits are taxable.

- Reduced Medicare Premiums: Staying below certain income thresholds can also reduce Medicare Income-Related Monthly Adjustment Amount (IRMAA) premiums, saving you further expenses.

- Tax Efficiency in Retirement: By lowering your AGI, you might have more room to manage other income-generating activities, like Roth conversions, tax gain harvesting, or large one-time distributions.

Strategic Considerations for Using QCDs

To implement QCDs effectively, you need to understand the specifics of reporting these distributions. Although custodians report QCDs as normal IRA distributions, it is crucial for taxpayers to indicate on their tax returns that a portion of the distribution is a QCD. This ensures that the distribution is not taxed as regular income. If you have a tax preparer, you will want to be sure to inform them that you performed a QCD, as this is not referenced on the tax form they will receive. For detailed guidance on how to report QCDs, refer to the IRS’s official QCD guidance.

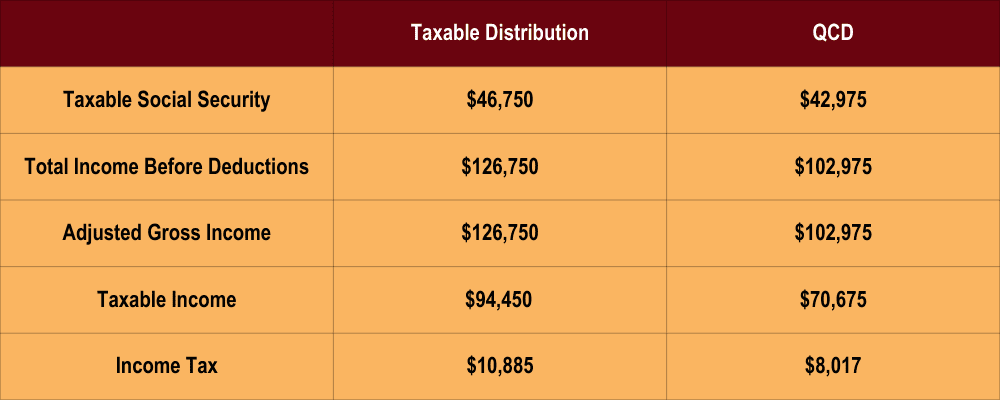

Visualizing the Benefit

To illustrate the benefits of QCDs, outlined below is a hypothetical scenario where a couple is taking $80,000 in IRA distributions on top of their income of $55,000 from Social Security, and giving $20,000 to charity. In the scenario on the left, they give the $20,000 as a cash gift from their bank account; in the scenario on the right, they give the $20,000 as a Qualified Charitable Distribution from their IRA. You can see the dramatic impact this has on their tax situation. It lowers the taxable portion of their IRA distribution from $80,000 to $60,000 and lowers the taxable portion of their Social Security from $46,750 to $42,975. This results in a difference in taxable income of $94,450 in comparison to $70,675, which creates a tax savings of $2,868. Simply by knowing the rules and following them, performing a Qualified Charitable Distribution could hypothetically result in a substantial tax savings of 26%!

Disclaimer: All content is for information purposes only. It is not intended to provide any tax or legal advise or provide the basis for any financial decisions.

To summarize, Qualified Charitable Distributions are not just a means of fulfilling philanthropic goals—they are a strategic financial tool that can significantly influence your tax liability and financial planning in retirement. By leveraging QCDs, retirees can maximize their giving potential while minimizing their tax burden, ultimately leading to a more secure and financially efficient retirement.

For further reading on how QCDs fit into broader tax strategies, revisit our in-depth articles on Gift Giving Tax Advantages and Tax Planning for Retirees. By integrating these strategies, you can ensure a comprehensive approach to your financial planning, making the most of your retirement years.

If you’re interested in exploring how QCDs can be integrated into your retirement and tax planning, consult with a financial advisor to tailor a strategy that fits your unique financial situation. Remember, proper planning today paves the way for a more prosperous tomorrow.

Sonmore Financial does not offer tax planning or legal services but may provide references to tax services or legal providers. Sonmore Financial may also work with your attorney or independent tax or legal counsel. Please consult a qualified professional for assistance with these matters. You should always consult with a qualified professional before making any tax or legal decisions.