Table of contents

Does it make sense to pay tax today in order to lower your lifetime tax liability? The answer is, it depends. There is a lot to consider when it comes to converting some of your pretax dollars to Roth. And, if after reviewing all your options, it might not make sense for you to do a Roth conversion today, it might be a good strategy in future years.

Things to Consider

Current Marginal Tax Rate

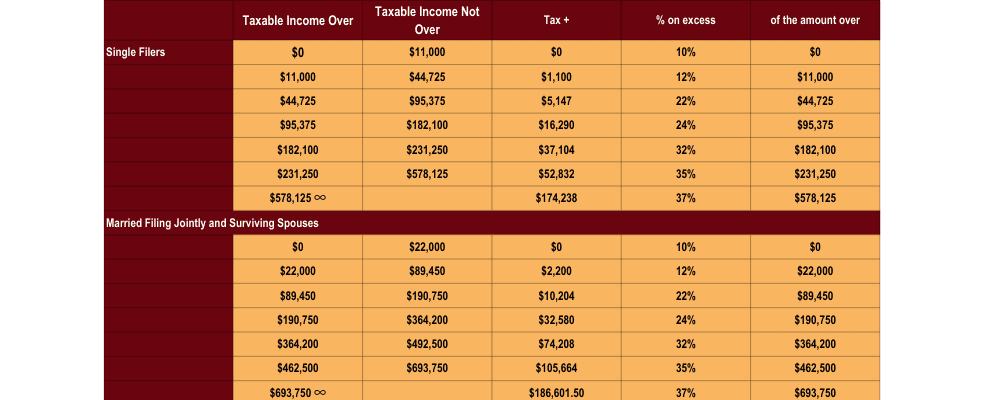

The very first consideration that you need to account for is one of the few known variables—your current marginal tax rate. For tax year 2023, the marginal tax rates for single filers and married filing jointly are:

As an example, if you are married filing jointly, your taxable income is $100,000 and you convert $10,000, the federal tax that you would be creating would be $2,200 or 22%. We use this, your current marginal tax rate, as a starting point to compare to estimates of future income tax rates.

Your Future Tax Rate

To estimate your future tax, we project what your future income will be, and then use current tax rates to forecast into the future. Gauging what tax rates may be in 3 to 5 years is substantially easier than trying to base an estimate on tax rates 20+ years into the future.

As an example, after 2025 if no future tax legislation passes, tax rates will go back to what they were in 2017, adjusted for inflation. For most people, this would be an increase in tax of 2-3% on their current marginal tax rate.

We often see compelling conversion opportunities in the years immediately following someone’s retirement, before they start drawing Social Security, and before they begin required minimum distributions. The most substantial drop in taxable income tends to happen in those years and, after reviewing the full scenario, we may be able to spend down non-retirement dollars that are not fully taxable when distributed.

Beneficiary’s Future Tax Rate

Depending on your objective as it relates to Roth conversions, it may help to extend your time horizon, looking beyond your lifetime tax and into your beneficiary’s tax as well. If it is reasonable to expect that you will leave an inheritance of retirement dollars to your beneficiaries, you should consider what your current tax rate is compared to what their future tax rate may be.

Though this can be challenging, your estimates don’t have to be 100% accurate, and you can use a simple elementary-level math problem to calculate it. For example, if you are in the 22% tax bracket today, we know that converting right now would cost you about 22% of whatever you converted. Therefore, in order for a conversion to make sense today, the tax rates in the future would simply have to be anything higher than 22%. Here is that elementary math problem for you:

22% < ? unknown rate of the future = convert today 22% > ? unknown rate of the future = pay tax in the future

It is common for beneficiaries to inherit those assets in their highest income-earning years, when they may not need the funds. If one of your beneficiaries is a high-income earner and you expect them to be a high earner well into the future, you might consider converting those dollars now so the total tax between the two of you would be less.

Pretax Account Balance

If you can spend down your pretax IRAs consistently over your lifetime such that you and your beneficiaries would both be able to stay in lower tax brackets, a Roth conversion may not make sense. If, however, you have a larger pretax account balance, and the account is growing faster than you are spending it, you might be more motivated to pay some of that tax today.

Even if you are in a low bracket today and you reasonably believe your beneficiaries will be also, you may be motivated to take that “unknown tax rate of the future” off the table. One way you could do that is by converting a portion of those dollars today.

Charitable Intent

If, in your estate plan, you plan to give a large portion of your IRA to a nonprofit like your church or another charitable organization, it may not make sense to do Roth conversions. The nonprofit will not pay tax when they receive those dollars, so if you were to convert those funds before giving them to the nonprofit, you may pay tax unnecessarily. Additionally, if you plan to gift a substantial portion of your pretax accounts through qualified charitable distributions, this also may make Roth conversions less compelling.

Targets and inflection points to consider

If, after thinking about all these factors, you have determined that you’re a good candidate for Roth conversions, here are a couple limits that you should consider when doing conversions:

Change in Tax Bracket

If you’re married filing jointly, and your taxable income is $100,000 before you do any Roth conversions, you could convert up to the top of the 22% bracket of $190,750 before that tax rate would change from 22% to 24%.

Social Security Taxation

If you are married filing jointly, and your combined income is below $32,000 in 2023, then none of your Social Security is taxable. (Combined income is your AGI + nontaxable interest + ½ of your Social Security Benefit.)

As an example, let’s say that in a year, you received $30,000 in Social Security benefit and an additional $20,000 in income from your IRA; you would owe zero income tax on your Social Security earnings. However, if your combined income is above $32,000, then your Social Security begins to be taxable income. If someone in this scenario was considering a Roth conversion, they would want to be mindful of how much that conversion would increase the taxation of their Social Security. This would not necessarily eliminate a conversion entirely, however, it is certainly something to think about. Let’s say this same couple was in their 70s and had a standard deduction of $30,700. They could convert $11,000 and still be in the 0% tax bracket—although this amount would start to make a portion of their Social Security taxable, it is offset by the standard deduction. Returning to our elementary math problem:

0% < ? unknown rate of the future

0% being less than the unknown rate of the future seems quite likely to be true

Medicare Part B Premium

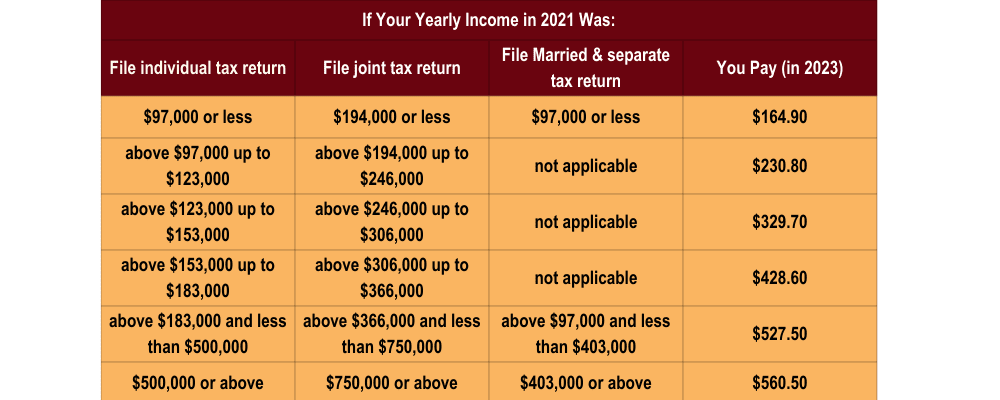

Once you are over age 65 and claiming Medicare benefits, you have a Medicare Part B premium that is based on your income two years prior. Here is the chart1 for 2023 income:

Again, increasing this cost may still be worth it, however, you would certainly want to be aware of the effect the conversion would have on your Medicare Part B premium.

Two Case Studies

The Smiths

The Smiths are a couple who have just retired; they are 62 years old and not currently drawing Social Security. Their mortgage is paid off and they have $1.5 million in pretax investment accounts. They have an additional $300,000 in non-retirement accounts with a $150,000 cost basis, and their plan is to defer taking Social Security benefits until their full retirement age of 67. Instead, they plan to spend from their non-retirement accounts from the age of 62 until those funds are exhausted. Imagine they will need $60,000 a year for living expenses. Getting that $60,000 by distributing from the non-retirement account would result in half gain and half cost basis in this example, generating $30,000 of long-term capital gain. The Smiths would be a prime candidate for a Roth conversion because they could convert in excess of $80,000 and still be below the 12% tax bracket.

The Does

The Does are in the same position as the Smiths, but have an annual need of $100,000 a year. They intend to gift all of their investment accounts to their church when they pass away. Someone in this scenario may not benefit nearly as much from a Roth conversion because the tax on those investment accounts when the couple passes away would be 0%. They still may have an incentive to convert some dollars today if they were in the 10% or 12% tax bracket, however, doing conversions into the 22% or 24% tax bracket with an annual need of $100,000 a year may not be as beneficial.

As you can see, there are many factors to consider when it comes to doing a Roth conversion. If you or someone you know would find value in discussing this further, please reach out.

1https://www.medicare.gov/Pubs/pdf/11579-medicare-costs.pdf