We have all been to a restaurant with a menu that looks like an encyclopedia and, instead of feeling glad we have options, we are frustrated because we don’t know what to order. In a similar way, employers have begun to offer increasingly diverse employee benefits that can be more confusing than helpful. Of course, we will not complain about an employer’s generously diverse benefits, but if we had to prioritize certain employee benefits and determine which ones can give us the biggest bang for our buck, which ones would we prioritize and how would we optimize them for our financial plan? Like many things in life, employee benefits are more about quality and less about quantity. In this post, we cover 3 common employee benefits that, if used correctly, can either help save your financial plan or be the catalyst that helps you retire early.

Employer-Sponsored Retirement Plans

The employer-sponsored retirement plan is a common one. There are various different types of employer-sponsored retirement plans and it is important to know which one or ones are available to you. You may be rolling your eyes saying, “I already knew I have to contribute to my 401k”. If that’s you, great. I hope you are contributing enough to at least get the match because a match may seem insignificant but can actually make quite a difference.

Why you should take advantage of an employer match

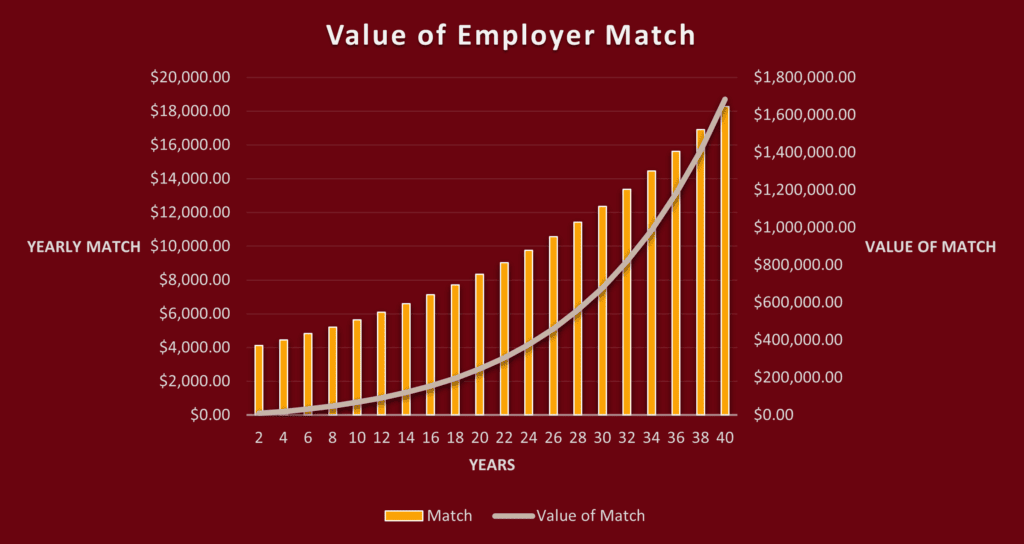

Let’s illustrate it below. Hypothetically, let’s suppose the following:

- You have wages of $100,000

- Your wages increase by 3% per year

- Your employer offers you a 4% dollar for dollar match

- You contribute enough to get the full match

- You earn an average return of 8%

What is the value of the match after 30 years?

The answer is about $745,000. After 35 years, it is worth $1,100,000 and after 40 it is worth $1,700,000.

This is the power of compound interest and what you are missing out on simply by not contributing enough to earn the full employer match.

Below is a visual illustration:

This hypothetical is for illustrative purposes only

Why the type of plan available to you matters

The reason the type of plan and features of the plan matter is because it can help you exploit tax planning opportunities and efficiencies that would otherwise go unclaimed. For example, let’s suppose you are towards the end of your career, and you’ve been saving in your 401k plan for the past 30 years. During these years, you were able to purchase company stock in your 401k plan (which is not a feature in every plan) and now own about 1,000 shares with a cost basis of $100,000 and a fair market value (FMV) of $500,000. Unbeknownst to you, you may have stumbled upon a massive tax planning opportunity.

Upon retirement, most people would simply roll their 401k into an IRA, which is fine. However, someone in the situation described would qualify for what is called Net Unrealized Appreciation (NUA) (If you want to learn more about NUA, you can read this article). This allows you to distribute the company stock in your 401k to a taxable non-retirement account and immediately pay tax on the cost basis of the stock, in this case $100,000, and pay Long Term Capital Gains tax on the gain ($400,000) upon sale of the stock at a future date. Which, if you play your cards right, can open up the doors to opportunities; for example, realizing Long Term Gains in the 0% Long Term Capital Gains tax bracket. If your filing status is Married Filing Jointly, the top of the 0% Long Term Capital Gains tax bracket is $89,250 in taxable income. If your only income is capital gains, you could realize about $115,000 in Long Term Capital Gain in tax year 2023 and pay zero tax. $115,000 in long term gain minus the standard deduction of $27,700 gets us to taxable income of $87,300 taxed at 0% because it is within the 0% capital gains tax bracket.

This example is only the tip of the iceberg, but it demonstrates why knowing the features and details of your employer-sponsored retirement plan is important.

Bonus Opportunities

Some plans have special plan-specific catch-up contributions that allow participants to contribute significantly more during the last couple of years before retirement. If this applies to you, you will not want to miss out.

457b Special Catch-Up

457(b) plans are defined contribution plans for state and local governments. They are similar to 401ks. However, 457b plans have a special catch-up rule that allows the plan participant to contribute up to the lesser of the following during the last three taxable years ending before their normal retirement age.

- Two times the basic annual limitation aka the normal contribution limit ($22,500 – 2023) so, $45,000, or

- The underutilized amount.

More details about the 457b catch up can be found here.

The underutilized amount is the sum of: (1) the basic annual limitation for the taxable year, plus (2) the difference between the basic annual limitation and the amount actually contributed by the participant for prior years.

By taking advantage of this special catch-up, a plan participant could potentially contribute $135,000, which is 45,000 more than could be contributed otherwise, even using the normal catch-up contribution.

Super 403b Catch-Up

403b plans are also similar to 401k plans, but 403bs are plans maintained by nonprofit organizations. After 15-years of service with a qualified organization, sponsoring plan participants could have the opportunity to make a special catch-up contribution of the lesser of the following:

- $3,000

- $15,000, reduced by the sum of

- amounts not included in gross income for prior taxable years by reason of this special 403(b) catch-up and

- the aggregate amount of designated Roth contributions (per IRC Section 402A(c)) permitted for prior taxable years by reason of this special 403(b) catch-up; or

- $5,000 multiplied by the employee’s years of service with the qualified employer, less all elective deferrals the employee made in prior years to the organization’s plans.

More details about the super 403b catch up can be found here.

Changes on the Horizon

In future years, there will be changes to on the taxation of catch-up contributions due to the Secure Act 2.0 signed in December of 2022. You can read more about those changes here.

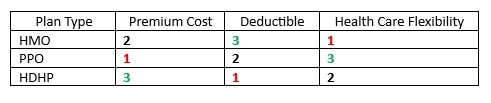

Health Insurance

Health insurance is an incredibly important benefit due to the high costs associated with healthcare. There are three types of commonly offered plans. The three most common health insurance plans are Health Maintenance Organization Plans (HMO), Preferred Provider Organization Plans (PPO), and High Deductible Health Plan (HDHP). Each plan has different pros and cons. We created a visual to illustrate the strengths and weaknesses of each. We created a rating from 1 to 3, with 3 being the best score and 1 being the worst.

For those who foresee big medical expenses such as building a family, it may be more beneficial to get a PPO plan since it provides the most flexibility in terms of providers and has a lower deductible. In other words, it allows us to shift more cost to the insurer.

For those with lower medical expense and who want to retire prior to age 65, a HDHP might be the most compelling option due to the ability to pair the plan with a Health Savings Account (HSA). We love Health Savings Accounts because they are the most tax-efficient savings vehicle to exist. You can contribute to an HSA and receive a pre-tax deduction from income. This pre-tax deduction also lowers wages subject to FICA tax which 401k plans and IRAs do not do. The HSA dollars can then be invested and, if used for medical expenses, can be distributed completely tax-free. Sounds like a great deal to me.

Disability Insurance

What would happen if you sustained an injury or illness so severe you were unable to work for a prolonged amount of time? This is what disability insurance is for. As you can imagine, for those in their working years, enduring a difficulty such the one described can totally derail a financial plan because the plan is contingent on the individual continuing to have wage income. Disability insurance replaces a percentage of your income due to the inability to work due to a serious injury or illness.

If your employer offers this benefit, it is important to take advantage of it. The most important things to know are the following:

- What is the definition of disability?

- Who is paying the premiums?

- What is the benefit amount?

- How long is the elimination period? And

- How long will the benefit last?

The reason we want to know those things is because, with that information, we’ll be able to know the following:

- What has to happen to be able to receive a benefit. Meaning, if I am able to work a job that is not the job I typically work, will I still receive benefits?

- Taxability of the benefits are determined by who is paying the premium. If your employer pays the premium, the benefits are taxable. If you pay the premium, then they are not taxable. This helps us determine the net benefit amount that would be received.

- The benefit amounts are expressed as a percentage of wages. 60-80% of wages is a typical benefit.

- Disability policies do not have a deductible. Instead, they have an elimination period which typically ranges from 90 to 270 days for Long Term Disability policies. The elimination period is the number of days the policyholder must wait before receiving a benefit after being declared disabled. We must factor this consideration in when determining what an appropriate emergency fund is. It should also be noted that the first disability check is not actually paid until 30 days after the elimination period ends.

- Disability benefits can range in duration. Some pay out for 2, 5, or 10 years and some even until age 65. We must know how long our policy will pay so we can have a plan around it in the unfortunate event we are presented with situations of this sort.

Be cautious of believing you do not need disability insurance. A 2019 study of consumer bankruptcy filings found that 77.8% of debtors cited income loss as a contributor to their bankruptcy. This included 44.3% specifically citing medically-related work loss as a contributor.

Employee benefits are not an easy matter to navigate. However, when properly analyzed and optimized, they can help you take strides towards achieving your financial goals. If you’d like to learn more about how you can optimize your employee benefits, we are just a phone call away.