“It’s not about what you earn, it’s about what you keep.” How many of us have heard that saying? Personally, I think it should be revised to “It’s not about what you earn, it’s about what you keep. But it always helps to earn more”.

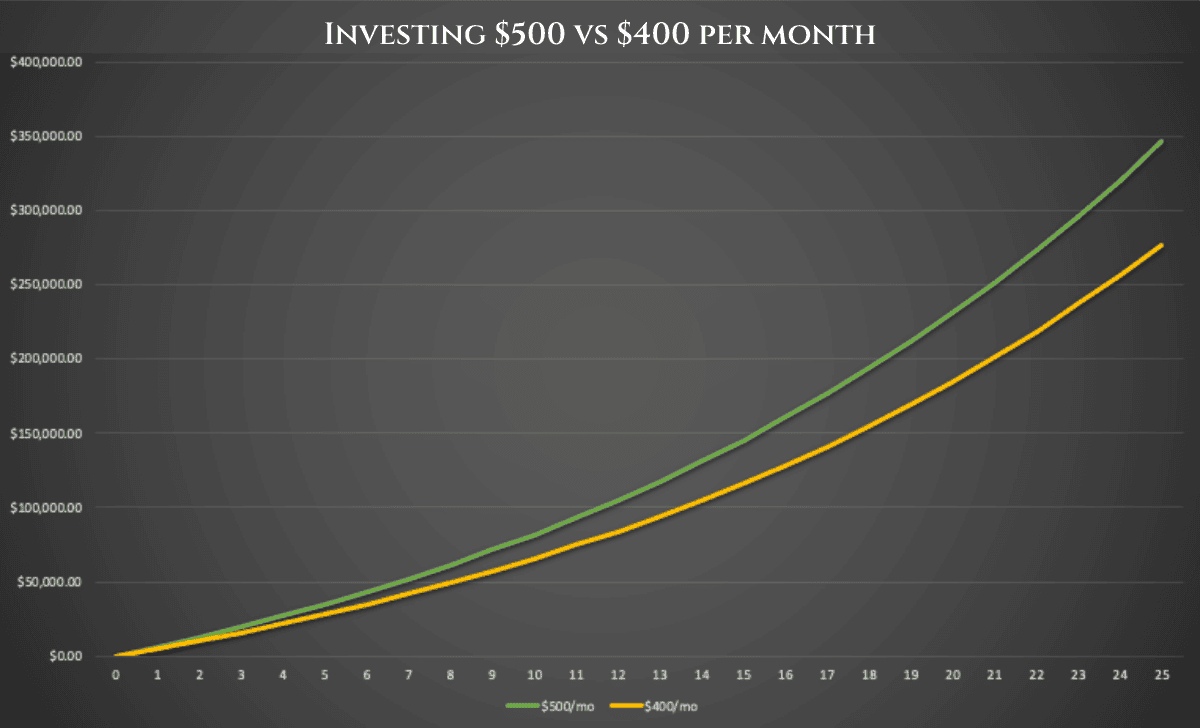

As Dave Ramsey says, “Personal finance is 80% behavior and 20% head knowledge,” and if we are disciplined and intentional with investments and retirement savings, we will succeed. However, the difference between saving $400 per month for 25 years and $500 per month for 25 years, both at a growth rate of 6%, ends up being $67,629. In other words, a $100 difference is substantial.

Here is a visual representation of the difference:

One may think, “Well duh, if I invest more, I will have more, but how do I get more money to invest?”

To ensure your future financial security, it is imperative you invest, but also that you are paid fairly for the work that you do. If you are currently looking for a new job or have not received a raise aside from the yearly 2-3% inflation raise, here are some tips and tricks to change that.

To get a first-hand account of what is important in salary negotiation and how to go about it, I had the honor of speaking with Liz, a highly successful woman in engineering who not only has had a successful engineering career, but has also been successful at significantly increasing her compensation. Liz studied Aerospace Engineering at Arizona State University and has worked for Honeywell, ViaSat, and Orbital ATK.

Increasing her compensation has not only given Liz the opportunity to be intentional with her investments and retirement savings, but also has made it possible for her to afford experiences for her kids, such as trying out new sports. Here, Liz and I will break down best practices for salary negotiation, including negotiation tactics and a scripted Q&A.

Best Practices of Salary Negotiation

Things to know while interviewing for a job and negotiating your new salary:

- Half the battle is actually asking for a raise or applying for a job. Even if you don’t have 100% of the “required” skills, take a stab at it and apply anyways! Liz shared, “Don’t shy away from applying because you only have half of what’s asked for because a lot of the time job descriptions ask for the absolute perfect candidate, which usually doesn’t exist.”

- You are NOT obligated to share your plan to have children. Employers are legally BARRED from asking questions of this nature and cannot discriminate against you because you have or plan to have children. Do not be afraid of redirecting the conversation with this line, courtesy of @apowermood on Instagram: “I’m not comfortable answering that. Let’s keep the conversation focused on the duties of this role and my qualifications.”

- You are NOT obligated to share your current salary. When interviewing a candidate for a position, companies have a compensation budget. If you show your cards right away by sharing your current salary, you could wind up being offered less than the company has budgeted for.

- Research your market rate and the company. The most important step in negotiating a salary increase, other than the actual act of doing it, is the prep work beforehand. Arm yourself with data and confidence. “Having also been an interviewer on panels of interviews, I’m shocked at how often people don’t know much of anything about the company or the products,” Liz shared. There are several sites that can be useful to get an understanding of compensation in your industry and possibly even your employer. These resources are not intended to be completely accurate, but rather to give you a ballpark idea of how much companies pay for the role you are looking to fill. You may be worth more, and if so, it is okay to ask for more. Be sure to take into consideration your experience level, previous notable accomplishments, and your geographic location. Here are some popular research sites:

Once you have done your homework, it’s important to work on the output, meaning how you will communicate that you want to be paid more. “In interviews, you have sometimes an hour of someone’s time to make an impression on them and they’re going to make a huge decision on hiring you based on one hour. If in that hour you can convince them that you’re worth, whatever it is, 100,000, 130,000, 150,000 to the company, you have to use that time valuably.

So, if you stumble around and are not prepared, then I don’t think you’re going to stand a good chance,” said Liz. To be able to stand out in an interview, she recommends lots of practice. “Worst case scenario, ask yourself questions in the mirror and have your answers rehearsed, so when it comes the day of, you can do it pretty fluently.” She also recommends doing substantial research and reading the job description well. “The job description will give you clues as to what has been their problem in the past.”

Negotiation Tactics

The best deal is undoubtedly one in which both parties feel like they won. For context, imagine the following scenario from the book Personality Selling by Albert J. Valentino:

You are looking to buy a car. You have a budget of $12,000 and plan on buying it in cash. You see a car online that you like, and it costs $14,000. You reach out to the seller and offer $12,000. The seller immediately replies with “SOLD”.

How do you feel? Probably not great because you are left wondering if you could have offered less, or you are left asking yourself, “What’s wrong with the car?”

Now suppose that the scenario is the same, but you offer $11,000 instead of $12,000. The seller comes back to you a couple hours later requesting $13,000, and you counter with $12,000. They seem hesitant and tell you they’ll get back to you. Some hours later, they respond and accept your offer. What changed? In both scenarios you paid $12,000. However, in one of them, you feel like you negotiated a great deal. You feel like you won.

In practice it could look something like this:

You are interviewing for a new company and your goal is to earn $85,000, which you determined to be a fair rate based on your personal accomplishments and current market rates. You briefly discussed compensation during the first interview when you were asked what kind of salary you were hoping to get. You responded, “Can you please share the salary range for this role? Since we’re still quite early in the interview process, I don’t have a handle on the full scope of everything that it entails so, I don’t think I can give an accurate number just yet.” They confirmed the range is $78,000-$95,000.

You are now on the final interview and get asked what your salary requirements are. You respond with the following:

“Now that I’ve learned more about the role and understand the responsibilities it entails, I believe $97,000 (Or whatever other number over your target salary) would be fair.”

The interviewer responds with $92,000.

You now do what Albert Valentino refers to as flinching, which is hesitating and acting as though you are doing the company a favor by accepting less than $97,000. You respond with: “I believe $95,000 would be more in line based on the research I’ve done on market rates, my level of experience, and the responsibilities of this role.”

The interviewer hesitantly agrees.

Congratulations! You negotiated a salary 11.75% over what you originally hoped to earn.

Obviously, not every situation will play out as smoothly as the example above, however, the three most important things to keep in mind are:

- Do your research.

- Do not be afraid of negotiating or asking for a raise.

- Be confident!

Most of those are easier said than done, but we know you are fully capable and hope this article inspires you and gives you the resources to take that step and help ensure your financial security.

Scripted Q&A

If you are struggling with thinking of common interview questions around compensation and how to answer them, here are a few courtesy of @apowermood.

What are your salary requirements?

Responses:

- Can you please share the salary range for this role? Since we’re still quite early in the interview process, I don’t have a handle on the full scope of everything that it entails, so I don’t think I can give an accurate number just yet.

- Based on my current market rate and the value that I bring into this role, my range is X to Y. Is that in line with your budgeted salary range?

What is your current salary?

Responses:

- Before we go into detail on salary, I’d like to know more about the scope of this role. Since we’re so early in the process I’m not clear on everything it entails

- I’ve done my research on this role and the market rates. Based on my market value and the current market rates I’m looking for something range from X to Y. Is that within your budget/range?

When giving your desired salary range you want your ideal salary to be in the lower half of the range giving you upside potential in your negotiations, while not appearing unrealistic.

Asking for a raise and negotiating your salary can be challenging, however, they are crucial for your financial wellbeing. Remember what a difference investing $100 dollars more a month made over 25 years? Similarly, increasing your salary by 10% can be life changing. The ball is in your court and it is time to take action. It is time to take control of your financial future. It is time to go from thinking about getting a raise to actually getting one.

Have you recently negotiated a salary or asked for a raise? We’d love to hear your story and learn how we can help you on your financial journey!

Disclaimer *this newsletter focuses on the financial aspects of compensation and not on the aspect of social equity*