Not running out of money during retirement is a financial goal.

Outperforming the market on the other hand, is not a financial goal. In the words of Nick Murray, “If I ‘outperform’ my neighbor by 3% in the 20 years to retirement such that he runs out of money when he is 79, and I don’t run out of money util I’m 84, it will not matter much when we are both sitting on a park bench at 86, without two nickels to rub together between us.”

So, how does one prepare to make their savings last through retirement? Here are four ways that, when done in conjunction, can help you make it through retirement without running out of money.

Budget

Undoubtedly, the most important part of any financial plan—and by far the most boring—is the budget. However, you can’t build a large pyramid without a wide base, and your budget is the base of your financial plan. At the end of the day, the point of having a financial plan is to ensure that your money will work for you today, tomorrow, 10 years from now, and so on until you no longer have to worry about money anymore.

The two biggest errors people tend to make when it comes to budgeting are making it too rigid and unrealistic or giving up on it too quickly. The very first step to building a strong and lasting budget is to do some homework ahead of time. Go through bank and credit card statements and make a list of all the money you’ve spent. The further back in time the better because you’ll have more data and will be able to get a more accurate idea of average monthly expenditures.

Next, determine your fixed expenses. These are the expenses that remain the same or relatively consistent from month to month. Examples might include your rent/mortgage, loan payments, utilities, insurance, and phone bill. Ideally, you will want to include retirement savings contributions in this category. If they are not currently part of fixed expenses, we’ll figure out how much we can add after determining if we are running a surplus or deficit.

Having determined your fixed expenses, it is time to list and quantify your variable expenses, including entertainment, clothing, eating out, hobbies, etc.

Once you have determined your monthly fixed and variable expenses, add them up and subtract them from your monthly net income. If the remainder is a negative number, you are running a deficit, and if the number is positive, you’re running a surplus. If you have a surplus, formulate a plan to allocate those funds. They could be used to bolster up savings, fund a vacation, or pay off debt. On the other hand, if you are running a deficit, you’ll need to go through your expenses and determine where you are overspending. Don’t be discouraged if you don’t get it right on the first try—it takes time to fine tune a budget. You can access a helpful budget spreadsheet by following this link.

Have a Savings Rate In line with Your Goals

A recommended savings rate for retirement may be around 15%. However, this rate will fluctuate depending on when you want to retire and what lifestyle you want to lead. If you are 45, have no savings, and want to retire at 55, you will be massively disappointed to learn how much you would need to save in order to maintain a lifestyle similar to your current one.

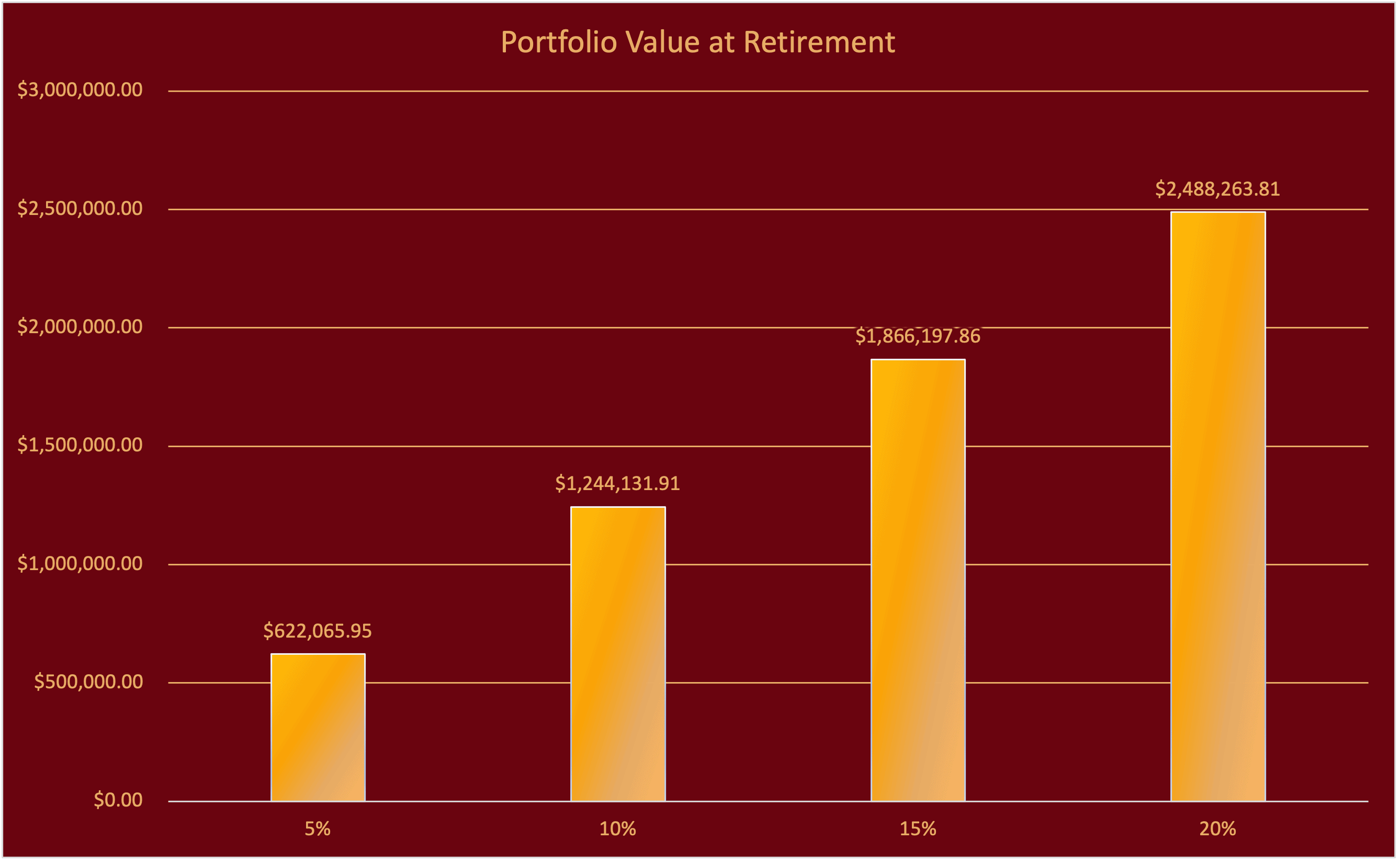

Time is the best friend of growth potential, meaning the sooner you start saving towards retirement, the better off you can hope to be. To illustrate this concept, consider the graphs below.

The first graph illustrates different savings rates (5-20%) of a household income of $90,000 and assumes the same variables for return and time: 7% and 35 years respectively.

From these portfolios, we could withdraw a distribution rate of 4% and receive the following annual income stream:

- 5% Savings Rate Portfolio: $24,882.64

- 10% Savings Rate Portfolio: $49,765.28

- 15% Savings Rate Portfolio: $74,647.91

- 20% Savings Rate Portfolio: $99,530.55

Keep in mind these amounts are NOT adjusted for inflation, making a $99,000 income 35 years from now is comparable to $25,000-35,000 in today’s dollars.

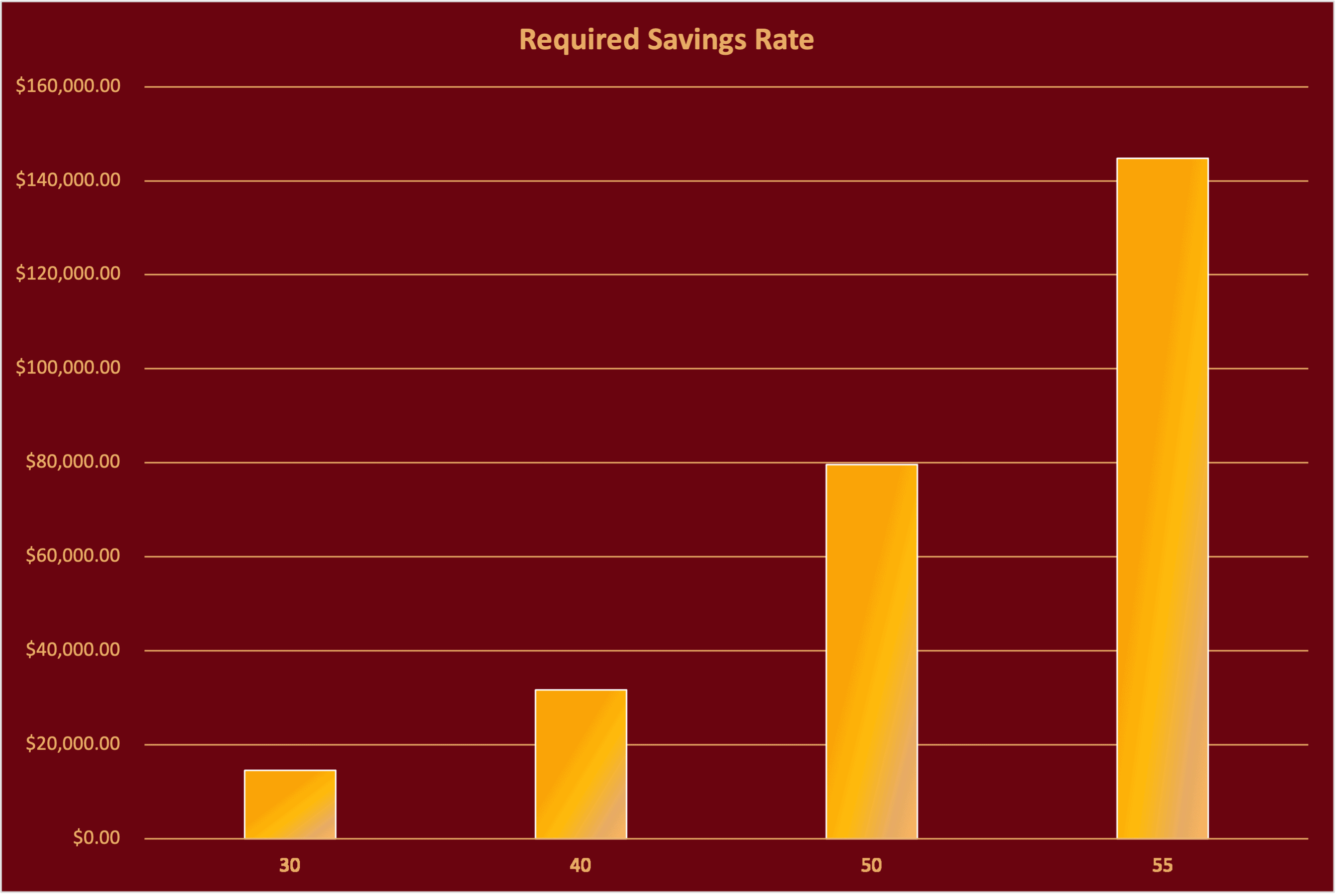

This second graph illustrates how much four individuals of different ages with the same savings goal of $2,000,000 would need to save per year given a desired retirement age of 65 and an annual return of 7%.”

As you can see it would be nearly impossible to achieve the $2,000,000 goal if someone was to start saving at age 50 or later. They would face having to decide between working longer or spending less/lowering their goal (or a combination of both.)

Allocate Appropriately

Arguably the second most important factor in investment returns (after behavior) is asset allocation.

If we wanted to simplify the concept of asset allocation and only look at the three basic investment classes (small cap stock, large cap stock (represented by the S&P 500), and bonds) and their inflation adjusted returns over the past 20 years, we would find small cap stock earned a return around 8.7%, large cap stock 7.5%, and bonds 4.8% according to J.P. Morgan Asset Management’s Guide to the Markets. What this really means is that a portfolio invested in all-stock compounded at over 2 times the rate of an all-bond portfolio. An all-stock portfolio doubled every 8-10 years and a bond portfolio every 24.

While everyone may not be able to stomach the rollercoaster of an all-stock portfolio, it is essential that you allocate appropriately based on your goals and time horizon. There is risk in every investment method. If you opt to invest in bonds or keep your retirement funds in cash because the stock market is too “risky,” you may be “safely” losing your purchasing power and more likely to run out of money during retirement.

Make Good Decisions

I feel that behavior is by far the single most important component in investing and that it dictates investor success 100% of the time. Two people could invest in the exact same fund, and one could earn a negative return while the other earned a 10% return all thanks to the behavior of each. Even those in fields such as science, engineering, tech, and math, stereotyped as the epitome of logical, can make emotional, self-sabotaging investment decisions. In the words of famed economist and director at Dimensional Fund Advisors, Gene Fama, “Your money is like a bar of soap. The more you handle it, the less you’ll have.”

I feel that if you want to make sure you don’t commit the biggest investment mistake possible, do one simple thing when equity markets tumble:

Nothing.

If this is something that’s difficult for you, it may help not to consistently check account values, refrain from listening to the news, have an appropriate asset allocation, and have someone in your corner that can talk you off the ledge, whether that be your financial advisor or a trusted friend.

If you need help thinking through any of the four topics discussed above or would like a second opinion to assess your retirement readiness, we are happy to be a resource. You can schedule a complimentary call.