Table of contents

There are many factors that go into discerning a job switch. Having a clear reason behind switching jobs is the most important piece because it helps you to align with the benefits you should be looking for. If the catalyst for making a switch is compensation-based, you might be more compelled by a job that offers equity compensation or phantom stock instead of the most comprehensive health insurance plans. It is important to consider total compensation and not just salary. We’ll cover three benefits that can make a large impact in your financial picture.

Vesting

Vesting is the process of gaining ownership of an employer-provided benefit and typically applies to 401k matching or equity compensation (RSUs, Stock Awards & Options, SARs, etc.). This can either be a big deal to those subject to it, or it may not apply whatsoever. There are two main types of vesting schedules: cliff vesting and graded vesting. In a graded vesting schedule, a pro rata amount is vested each year; while in a cliff vesting schedule, the whole amount is vested on the final year. You can read this article to learn more about vesting schedules and equity compensation. Vesting is important when considering benefits due to the possibility of leaving money on the table when switching employers. If you receive an RSU grant worth $100,000 subject to a 3-year cliff vesting schedule and you leave your employer in year 2, you are essentially walking away from $100,000. This scenario can play out in many ways, but the main takeaway is that vesting should be a consideration when contemplating a job switch.

Retirement Plan

Most large employers, whether public or private, will offer some type of defined contribution plan (401k, 403b, 457b) and likely a match on your contribution up to a limit. Defined contribution plans are the most common employer-sponsored retirement plans and the employee bears the investment risk. A less common retirement plan is the defined benefit or pension plan in which the employer bears the investment risk. With this plan, the benefit amount is based on years of service and average earnings over a select period of time. In a defined benefit plan, the employer contributes significantly to the plan for the employee, which cannot be said for most defined contribution plans.

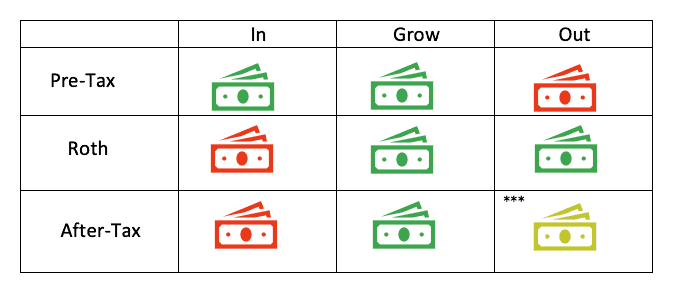

Some neat features to look for in defined contribution plans are Roth contributions, after-tax contributions, in-plan conversions, and in-service rollovers. These are all uncommon features but can be extremely useful to those looking to stash away as many tax-advantaged dollars as possible. The latter three features are much more uncommon than Roth contributions, but are great tools to take advantage of if your potential employer happens to offer them. Below is a visual and a brief breakdown of each feature and how it can be used.

With Pre-Tax contributions (traditional) the employee gets a tax deduction from earned income equivalent to the contribution amount. For example, if the employee made $100,000 and contributes $10,000 to their 401k on a Pre-Tax basis, they would be taxed as if they made $90,000. The contributions grow tax-deferred and qualified distributions after age 59.5 are subject to ordinary income tax rates.

Roth contributions are the inverse. There is no tax deduction for Roth contributions, but the contributions grow tax-free and qualified withdrawals are tax-free. There is no income limitation for Roth 401k contributions, unlike Roth IRAs.

After-tax contributions can receive similar treatment to Roth contributions if the correct steps are taken. These contributions are made after the 401k contribution limits have been met ($20,500 for under age 50, $27,000 for age 50+). After-tax contributions are subject to the 415(c)(1)(a) limit ($61,000) and include employee contributions plus employer match. So, if you maxed out at $20,500 and your employer matched $4,500, you’d be at $25,000 and have the ability to contribute another $36,000 before hitting the after-tax limit. In terms of taxability, after-tax contributions are not tax deductible, they grow tax-deferred. If left in the 401k, the gain is taxable at ordinary income tax rates upon distribution. Unless you roll the after-tax contributions into a Roth IRA account, in which they would receive Roth treatment and never be taxed. Rolling after-tax contributions out of the 401k plan and into your Roth IRA is called an In-Service Rollover. Theoretically speaking, you could contribute nearly $60,000 a year on a Roth basis using this strategy.

Lastly, In-Plan Conversions. In this case the 401k plan would allow for the participant to convert pre-tax contributions to Roth. This is a taxable event. Like any of the information in this article, whether this should be done is contingent on the individual situation of the plan participant.

Health Insurance

Health insurance is likely one of the most sought-after benefits, as high medical costs have the ability to completely derail a financial plan. However, these benefits vary from employer to employer. Assuming the employer offers health insurance, there are three main options: Health Maintenance Organization Plans (HMO), Preferred Provider Organization Plans (PPO), and High Deductible Health Plan (HDHP).

HMO Plans

HMO plans typically have a lower cost than PPO plans but not HDP. In an HMO plan there is a primary care physician who must refer you if you wish to see a specialist. The providers used must be within the network of providers allowed in order to receive coverage. With this type of plan, flexibility is sacrificed to lower costs. HMO subscribers who receive nonemergency, out-of-network care have to pay for it out of pocket.

PPO Plans

PPO plans are generally more expensive than HMO plans. However, they are a bit more flexible. Subscribers of PPO plans can visit in-network providers or can opt towards out of network providers for a higher cost. Additionally, PPO subscribers do not need a referral to see a specialist. PPO plans also have a deductible which must be covered before the insurer will cover all medical costs.

HDHP

High deductible health plans are the most cost-effective due to their high deductible, a high out of pocket cost before the insurance kicks in. What makes HDHPs compelling is access to a Health Savings Account (HSA). Health Savings Accounts are tax unicorns. Contributions to an HSA are deductible, they can be invested and grow tax-deferred, and distributions for medical expenses are tax-free. Generally, this type of plan is a slam dunk for people with low yearly health care expenses and cash on hand.

Assuming these three options are available to you, deciding between them can appear daunting. Two important factors are foreseeable health care expenses and average yearly health care expenses. If you plan on building a family, perhaps a plan with a lower or no deductible, but higher monthly premium makes the most sense for you. Since you would be spending a lot on healthcare, you’ll be able to shift more cost to the insurer this way. If you generally don’t have many healthcare expenses and are aiming for early retirement, then a HDHP might be more helpful in meeting your goals due to lower monthly costs and the ability to save into an HSA. This can help pay for healthcare expenses prior to Medicare eligibility.

Disability Insurance

Lack of disability insurance can also derail a financial plan. There are two main types: long-term disability (LTD) and short-term disability (STD). Disability insurance is insurance against your inability to work due to a serious injury or illness. Usually, you must be disabled for a minimum number of days for the insurance to kick in, this time frame is called the Elimination Period. STD polices have an elimination period of 7 to 30 days, with 14 days being the most common. The insurance will then pay out a percentage of lost wages on a weekly basis for a predetermined amount of time.

STD coverage typically covers 40-70% of lost wages and has a time frame of less than a year. LTD coverage has an elimination period of at least 90 days and can be longer in order to lower the cost of premiums. The benefit amount is around 60-80% of wages and can be paid out for 2,5, or 10 years and in some cases, for life.

Due to the benefit amount being a percentage of wages, insurance costs more relative to your earnings. The cost of disability insurance is typically 1-3% of pre-tax yearly wages and is mostly covered by the employer if the benefit is offered. Private coverage can be obtained and is highly encouraged if your employer does not provide it. As stated before, loss of income due to an illness or injury can derail a plan. The chances of being disabled for at least 90 days at some point during your working career are about 30% according to the JHA Disability Fact Book.

In a highly competitive labor market, employers are forced to offer more than just competitive salaries. When considering a job switch, equity and retirement plans, health insurance, and disability insurance are all factors that can make the difference between choosing employer A over employer B, or making the choice to stay at your current employer.

Get in touch with us today if you’re thinking of changing employers.