Table of contents

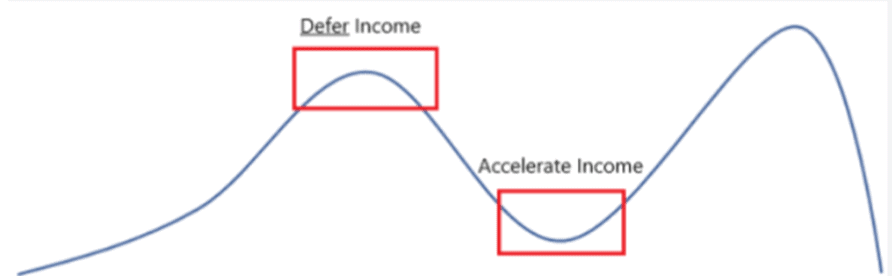

Tax and planning are words that are not typically associated together. Oftentimes, people think about taxes and conclude; “you just have to pay them” or “there is nothing you can do about it”. That, of course, is not true. If you can look at your taxes beyond a 12-month period of time, several planning opportunities exist to help lower your lifetime tax. In high marginal tax years, the objective is to lower your taxable income. In low marginal tax rate years, the objective is to accelerate income. See chart below.

Counter Viewpoints

There are multiple objectives out there; the most common one, solicited by several tax preparation tools, is refund season. The objective seems to be that when it comes to taxes, you should be working to pay more into taxes to ensure a refund when it comes time to file your taxes. To state this simply in an example: if you paid in $10,000 in taxes, your actual tax liability was $8,000, giving you $2,000 back.

Another viewpoint is to aim for your taxes to be as low as possible in the current tax year. I know this one sounds like it makes a lot more sense, but this also may not be the best strategy for mitigating your lifetime tax. Imagine that tax rates are at a 30-year low, you’re in the 22% marginal tax rate. Effectively, you believe that your marginal rate will be higher than 22% 20 years from now. When stated that way, you now see that it may make sense to make Roth contributions into a 401(k) or an IRA as opposed to doing pretax contributions.

You could write a book on all the tax planning opportunities that exist. You would rewrite that book many times over a decade. As it relates to this article, I will be highlighting some of the most common strategies that exist for people as they approach retirement, and once they enter retirement.

Strategies Before Retirement

One of the biggest tax planning tools before retirement is tax-favored contributions. You can access tax-favored contributions through IRAs, 401(k)s, health savings accounts, and stock options.

Don’t be fooled by the lack of sophistication, these tools can do some heavy lifting. For an IRA, you can make tax-deductible IRA contributions if you are below the income limit. You can also make Roth contributions that grow tax-free, then come out taxfree, if you are below the income limit. If you are above both limits, then you may be able to do what is referred to as a nondeductible IRA contribution, then convert those funds into your Roth IRA.

Your 401(k) has very similar features in terms of higher contribution limits. One nice thing about your 401(k) is that there are no income limitations on pretax or Roth contributions. Some 401(k) plans also have the ability to make after-tax contributions. This is different than Roth contributions. You might use a tool like this if you had maxed out your 401(k), for 2023 that is $30,000 if you are over age 50. You may also consider maxing out your IRAs, which is $7500 if you’re over age 50 in 2023. If you used the after-tax bucket in your 401(k), you typically can contribute in excess of $20,000 a year into the after-tax portion of the 401(k). These funds can then be rolled over into your Roth IRA, where they would grow tax-free. Effectively, this would allow you to put in excess of an additional $20,000 into your Roth IRA.

One of the biggest dark horses as it relates to tax planning is the health savings account. The contribution limits are not nearly as high as your 401(k) or combined IRA contributions. However, the nature of the accounts tax deductibility for contributions, tax free growth, and tax-free distribution is unlike any other account. If these funds are used for health expenses, the distribution can be taken tax-free. You can invest these dollars just like in a company 401(k). Unlike a flexible spending account, FSA, these funds follow you if you ever leave your employer, as well as the funds rollover year over year. The max contribution limit for a family over age 55 is $8750 for 2023. If you did this just over the last five years of retirement, you could build up around $50,000 into a health savings account that you could then use to have a higher deductible health plan from age 60 to 65 before you got on Medicare. Additionally, you can take distributions from your health savings account for expenses that occurred in previous years as long as you are able to prove that you had those expenses. We often refer to these accounts as “tax unicorns”.

The last tax planning opportunity as it relates to strategies before retirement is around stock options. In short, companies often will incentivize you by providing discounts or giving stock to you for participating in the company’s upside and downside. You typically need to satisfy a certain holding period to access the options and receive the full tax benefit. The holding period depends on the type of stock option. Once you satisfied the holding period, it may make sense to sell the position and use the cash to allocate across the rest of your plan, potentially using to fund some of the more tax advantageous accounts that we highlighted above. You also may use it to fund some of your charitable contributions if the stock positions have larger gains. If you’d like to learn more on this, you can read our blog here.

5 Common Strategies in Retirement.

Distribution Strategies

Not all distributions are taxed the same way. To state it very simply, if you take a distribution from your IRA in the amount of $10,000, or if you take a distribution from your savings account for $10,000, the IRA shows $10,000 of taxable income, and the savings account has no tax consequence at all. This is true even more so as you look across all your investment accounts. For a lot of retirees, they end up with four different types of investment accounts: pre-tax, Roth, non-retirement, and health savings accounts. A distribution from each one of these accounts is taxed in a different way. You can manage your distributions to target a certain income. This is particularly helpful if you are trying to stay within the 12% tax bracket, if you’re trying to stay below the threshold for the next Medicare premium increase, or trying to manage income to a certain MAGI (modified adjusted gross income) to qualify for The Premium Tax Credit (PTC) (if you are getting a healthcare.gov plan for health insurance before 65).

Roth Conversions

Roth conversions are the tool most used to accelerate income when taxes are low. We often refer to the years after the year you retire (and before you start drawing social security and taking RMD’s) as the gap years because there is a gap in income. These tend to be your best opportunities for Roth conversions. Depending on someone’s situation, we are commonly trying to fill up the top of the tax bracket they are in, without rolling up to the next bracket. As an example, we might fill up the rest of the 12% tax bracket, but not roll up to the 22% bracket. The objective of this is to pay tax at what we believe is a lower tax rate today than what it may be in the future in retirement or in the future when your heirs inherit the funds (likely in their highest earning years).

Tax Gain Harvesting – Non-Retirement Accounts

Like Roth conversions, tax gain harvesting is an income accelerating tool. You would do this in years where income is low, particularly if you are in the 0% capital gains bracket, and have the ability to realize gains and the tax liability is zero that can be a very compelling time to realize gains. If you then decided to sell that position in the future, the cost basis would be higher and the realized gain would be less, which would mitigate the tax liability.

Tax Loss Harvesting

Tax loss harvesting is simply the opposite of tax gain harvesting. Typically, throughout a year we will realize losses in client’s non-retirement accounts as they occur. The objective in doing this is that if we sell a position that has a gain, we can use the realized loss to offset that realized gain. If you don’t have any gains to realize in that year, you can carry the loss forward into future years and use $3000 a year to offset ordinary income.

Net Unrealized Appreciation

Occasionally, we encounter an individual who has company stock in their 401(k). In these scenarios, you are offered the option of rolling those funds into a non-qualified investment account, where then you could realize those gains at more favorable capital gains rate, as opposed to ordinary income. Depending on the size of the concentrated stock position, and the liquidity needs of the individual, this can be a compelling strategy to lower your lifetime tax. It also can be a compelling tool to satisfy charitable contributions. To learn more information on this, you can read our blog here.

Charitable Planning – Both in Retirement and Before

Gifting Appreciated Assets

If you have investments in a non-retirement account and make annual charitable contributions, you would be wise to consider gifting the appreciated assets in the account to your charity of choice as opposed to gifting cash. The logic for this is when you sell that position down the road, it would be subject to capital gains tax. However, if you gift that stock to your charity of choice, the gain is not taxable to you or the charity. This is simply a more tax-efficient way to give. As mentioned before, you could use concentrated stock positions from stock options, net unrealized appreciation, or simply assets that you’ve accumulated in a non-retirement or nonqualified account.

Bunching Contributions

Another common strategy we see implemented is bunching charitable contributions into the same tax year. This is commonly facilitated through a donor advised fund (DAF). The objective is to get to a spot where you would take the standard deduction in one year, but then itemize in the other year, where you may not have itemized in both otherwise. This can be a strategy that is implemented before retirement as well as in retirement. Oftentimes, if people are making charitable contributions based off of their income, they may not be itemizing as much in retirement as they may have when they were working since their charitable contributions may be less and their mortgage interest is either less or completely gone. That is where a bunching strategy can be quite effective in helping to lower your lifetime tax.

Qualified Charitable Distributions

Once you reach the age of 70 ½, you are eligible to do qualified charitable distributions or QCDs. This allows you to gift some or all of your RMD as long as it’s below $100,000 to a charity of your choice. The advantage to doing this is that, as long as it goes directly from your IRA to the charity of your choice, the distribution is not taxable. Otherwise, if you were to have that distribution paid to you, then gifted to your church, the distribution would be taxable to you and may or may not be tax deductible to you when you gift it to the charity of your choice. As I mentioned previously, oftentimes when individuals get to retirement, they may not be itemizing every single year, so any charitable contributions that you may have may not have a tax benefit. This can be a compelling strategy to use so that your charitable contributions still have a tax benefit to you. For more detail on charitable giving, you can go to our blog post on the topic by using this link.

You can now see how more tax opportunities exist as you approach retirement and go through retirement. If you’d like to have a deeper discussion on any of these topics, feel free to reach out or find more information on our process here.